The cryptocurrency market witnessed a significant development on February 26, 2024, as Bitcoin, the world's leading digital currency, surpassed the crucial $53,000 mark. This surge marks Bitcoin's highest price point since May 2021, signifying a notable comeback after a period of relative stability.

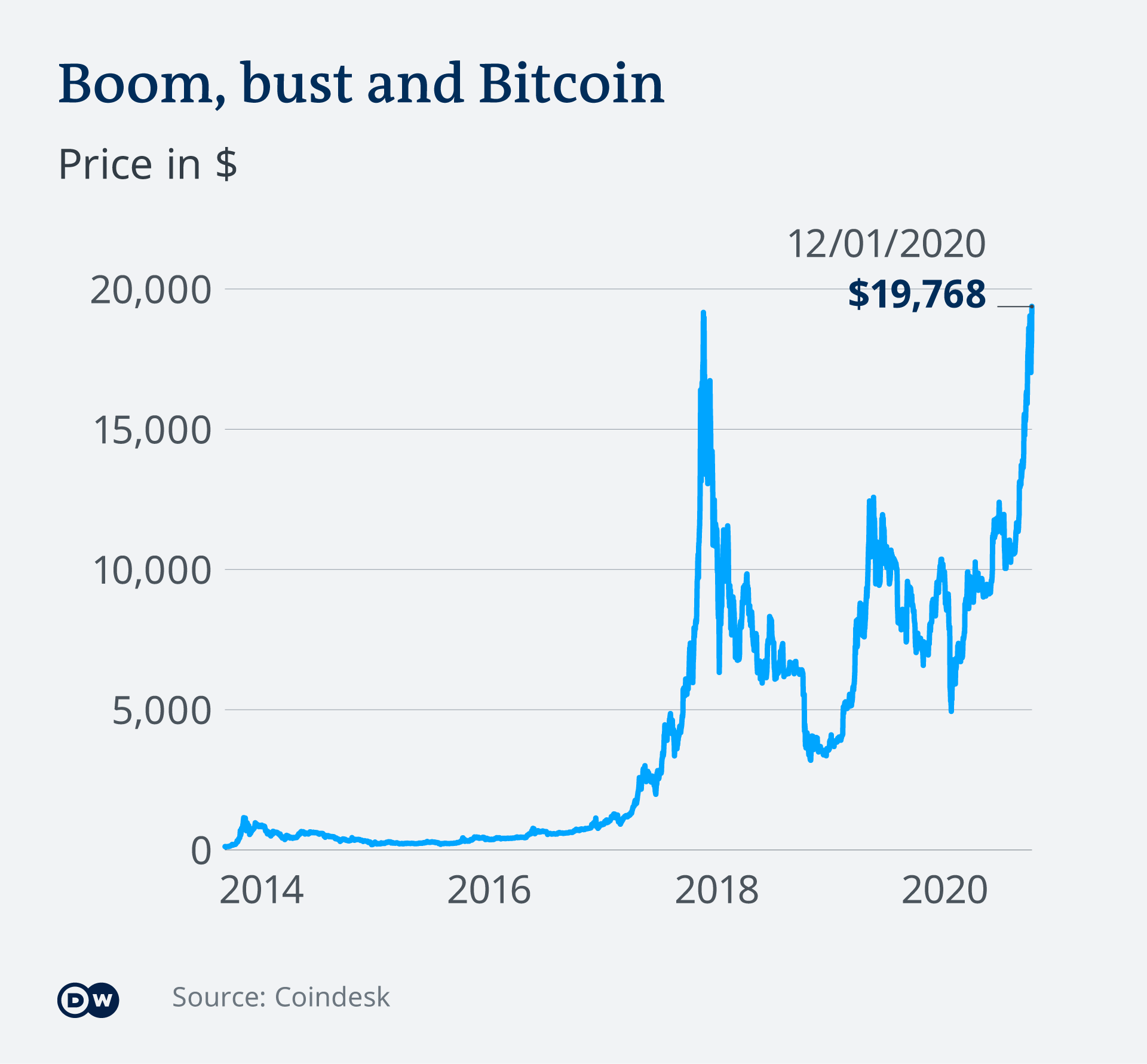

The recent price increase follows a period of several months where Bitcoin's value fluctuated within a narrow range. This stability contrasted sharply with the significant volatility that characterized the cryptocurrency market in 2021, when Bitcoin reached its all-time high of nearly $59,000 in November.

Several factors are believed to be contributing to the current upswing in Bitcoin's price. One major driver is the increasing inflow of investment into Bitcoin exchange-traded funds (ETFs). These investment vehicles allow traditional investors to gain exposure to the cryptocurrency market without directly purchasing and holding Bitcoin themselves. The launch of several new Bitcoin ETFs in January 2024 has attracted significant investment, contributing to the rise in demand and price of Bitcoin.

Another factor influencing the positive sentiment is the upcoming Bitcoin halving event, expected to occur in April 2024. This event, which occurs roughly every four years, reduces the amount of new Bitcoin entering circulation by half. This limited supply, coupled with increasing demand, is historically associated with price increases for Bitcoin.

Furthermore, recent developments in the regulatory landscape surrounding cryptocurrencies are also believed to be playing a role. In February 2024, the Securities and Exchange Commission (SEC) in the United States clarified its stance on the classification of certain digital assets, potentially paving the way for clearer regulations and greater institutional adoption of cryptocurrencies, including Bitcoin.

The current price surge has generated excitement and optimism within the cryptocurrency community. However, some analysts caution that the market remains volatile, and investors should exercise caution and conduct thorough research before making any investment decisions.