Gold prices experienced a surge on Monday, fueled by market expectations that the Federal Reserve will initiate interest rate reductions as early as June. This bullish sentiment comes on the heels of recent signals from the Fed suggesting a potential shift in monetary policy.

While the central bank has prioritized combating inflation through interest rate hikes, recent economic data has sparked a debate. Inflationary pressures, though still a concern, appear to be easing slightly. This has led some investors to believe the Fed may be nearing a peak in its tightening cycle, potentially paving the way for future rate cuts.

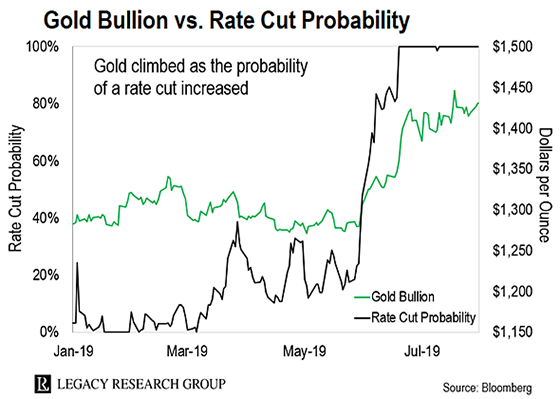

Lower interest rates are generally considered positive for gold. Unlike interest-bearing assets like bonds, gold doesn't offer a steady stream of income. When interest rates rise, the opportunity cost of holding non-yielding gold increases, making it less attractive to some investors. Conversely, a decrease in interest rates makes gold a more appealing investment option.

The prospect of a dovish shift by the Fed also weakened the US dollar. The dollar tends to have an inverse relationship with gold. When the dollar strengthens, it becomes more expensive for buyers holding other currencies to purchase gold. Conversely, a weaker dollar makes gold a more affordable hedge against inflation and economic uncertainty.

Market participants are closely monitoring upcoming economic data releases, particularly the core Personal Consumption Expenditures (PCE) price index scheduled for Friday. The PCE is a key inflation gauge for the Fed, and a positive reading could solidify market expectations of a June rate cut, potentially pushing gold prices even higher.

However, some analysts caution against excessive optimism. The Federal Reserve Chair, Jerome Powell, has reiterated the central bank's commitment to curbing inflation. While the pace of rate hikes may slow down, the Fed is likely to remain vigilant until inflation falls more demonstrably in line with its target range.

Additionally, geopolitical tensions and ongoing supply chain disruptions continue to pose risks to the global economic outlook. These factors could reignite inflationary pressures, prompting the Fed to maintain a hawkish stance for longer than anticipated.

Despite these uncertainties, the market's current sentiment is decidedly bullish on gold. With the prospect of lower interest rates and a weaker dollar looming on the horizon, investors are seeking refuge in the traditional safe-haven asset. In the coming weeks, data releases and pronouncements from the Fed will be crucial in determining the future trajectory of gold prices.