Saudi Arabia's Public Investment Fund (PIF) has achieved a significant leap in the global sovereign wealth fund landscape, solidifying its position among the world's leading investment institutions. According to a recent report by the US-based Sovereign Wealth Fund Institute, PIF has climbed to the fifth spot in the rankings, boasting net assets that are rapidly approaching the coveted one-trillion-dollar mark.

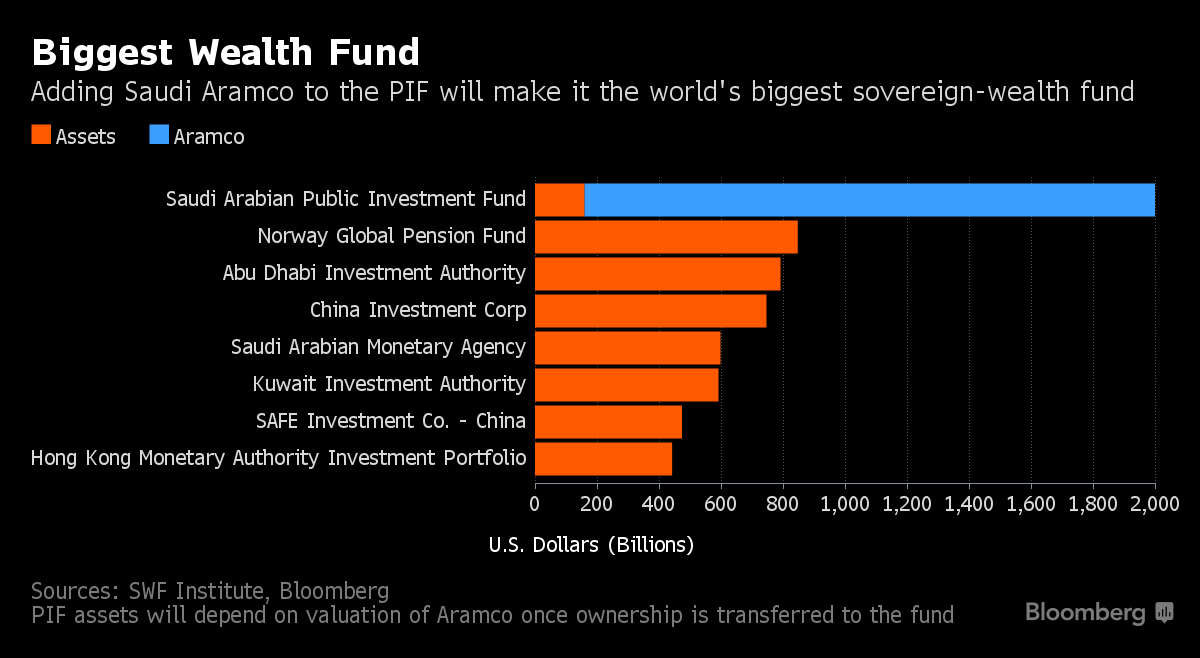

This impressive rise is attributed to a combination of strategic investments and a focus on economic diversification. A key factor propelling PIF's growth was the acquisition of an additional eight percent stake in Saudi Aramco, the state-owned oil giant. This move significantly bolstered PIF's portfolio, with its holding in Aramco estimated to be worth around $328 billion.

The ambitious target of reaching $1 trillion in net assets by the end of 2025 appears increasingly achievable for PIF. This goal aligns with the Kingdom's broader economic transformation strategy, which aims to lessen dependence on oil revenue and cultivate new sectors for sustainable growth. PIF is actively deploying its vast resources to fuel this diversification by investing in various industries, including technology, tourism, and renewable energy.

PIF's growing influence extends beyond the domestic sphere. The fund has been actively pursuing international investment opportunities, solidifying its presence as a major player on the global stage. This outward expansion not only generates substantial returns but also fosters strategic partnerships that contribute to the Kingdom's economic diversification objectives.

The recent surge in PIF's ranking reflects the growing confidence in Saudi Arabia's economic trajectory. The fund's robust financial performance serves as a testament to the Kingdom's commitment to economic reform and its vision for a future less reliant on hydrocarbons. As PIF continues to expand its footprint and diversify its holdings, its impact on the global financial landscape is poised to become even more significant.