Saudi Arabia witnessed a significant shift in its foreign investment landscape in 2023, with China emerging as the leading source of greenfield investments. China poured a substantial $16.8 billion into the kingdom, marking a staggering 1,020% increase from the previous year. This surge surpasses traditional investment powerhouses like the United States and European countries.

Analysts attribute this rise to two key factors: China's growing demand for Saudi Arabia's vast oil reserves and its ambition to bolster its Belt and Road Initiative (BRI) projects in the region. The BRI is a multi-billion dollar infrastructure development strategy that aims to connect China to other countries in Eurasia and Africa through a network of land and maritime routes. Saudi Arabia's strategic location makes it a crucial link in this initiative.

The influx of Chinese capital is anticipated to significantly impact Saudi Arabia's economic diversification efforts, which aim to reduce the country's dependence on oil revenue. A significant portion of the Chinese investment, $5.6 billion, has specifically targeted the automotive sector. This includes a major deal signed between Chinese electric vehicle manufacturer Human Horizons and the Saudi Arabian Ministry of Investment. The agreement involves establishing a comprehensive automotive facility in Saudi Arabia, encompassing research, development, manufacturing, and sales.

This collaboration is expected to contribute to Saudi Arabia's aspirations to become a regional hub for electric vehicle production. The kingdom aims to leverage this investment to not only develop its domestic EV industry but also position itself as a key player in the global transition towards sustainable transportation.

Beyond the automotive industry, the windfall from China is likely to be channeled into other sectors crucial for economic diversification. Saudi Arabia has set an ambitious target of attracting over $100 billion in foreign direct investment (FDI) by 2030. The Chinese investments provide a significant boost towards achieving this goal, and the funds are likely to be directed towards infrastructure development, renewable energy projects, and other industries identified for growth.

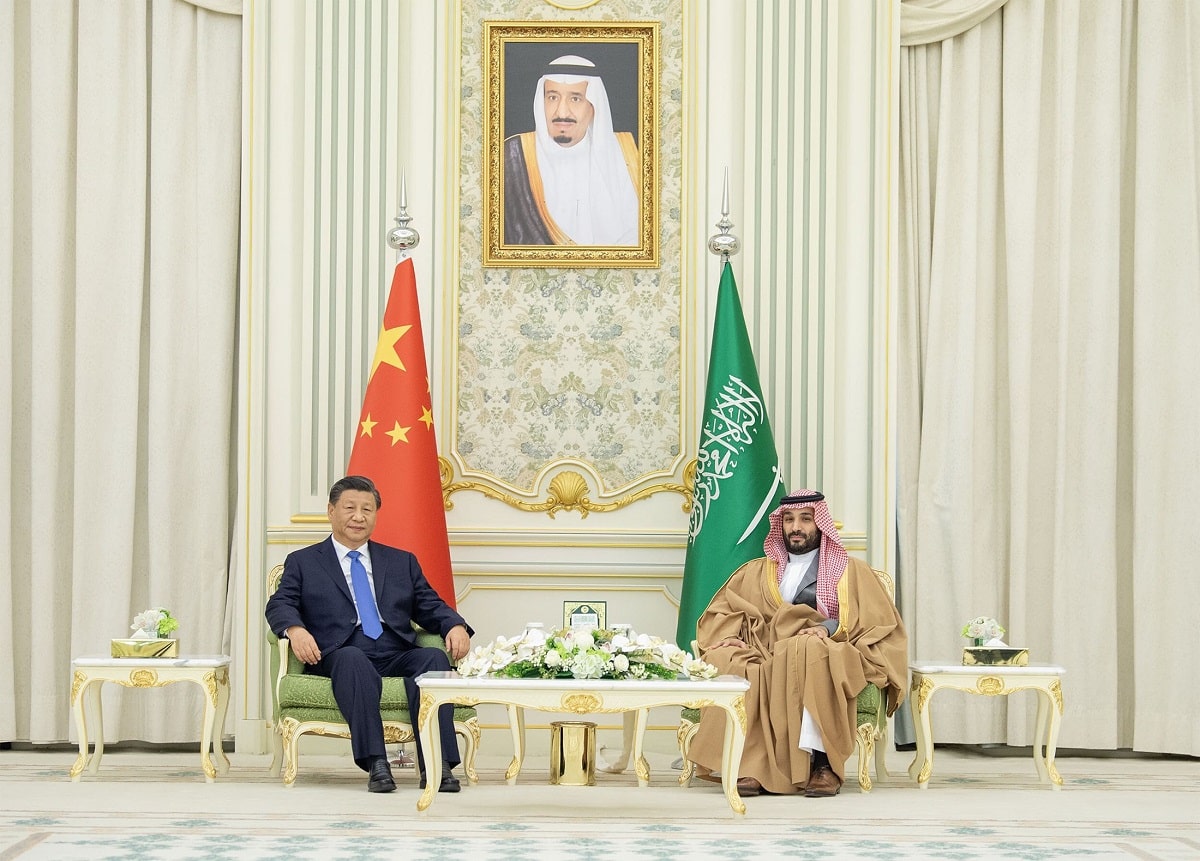

The growing economic ties between China and Saudi Arabia are likely to have broader geopolitical implications as well. The deepening relationship could influence global energy markets, particularly the pricing and supply of oil. Additionally, cooperation on BRI projects could further strengthen China's economic and political influence in the region.

While the surge in Chinese investment presents exciting opportunities for Saudi Arabia's economic development, it also necessitates careful consideration. Some analysts caution about potential challenges, such as ensuring transparency in deals and managing the impact on the local workforce. Nevertheless, there is no doubt that China's emergence as a top investor in Saudi Arabia marks a significant development that will reshape the economic landscape of the region for years to come.