Uncertainty clouds the future of the prominent Filecoin project STFIL after reports emerged that its development team is being probed by Chinese authorities. This news comes amidst a wider crackdown on Filecoin equipment manufacturers accused of running pyramid schemes. Additionally, a significant transfer of STFIL's FIL tokens to an unidentified wallet has heightened concerns within the investor community.

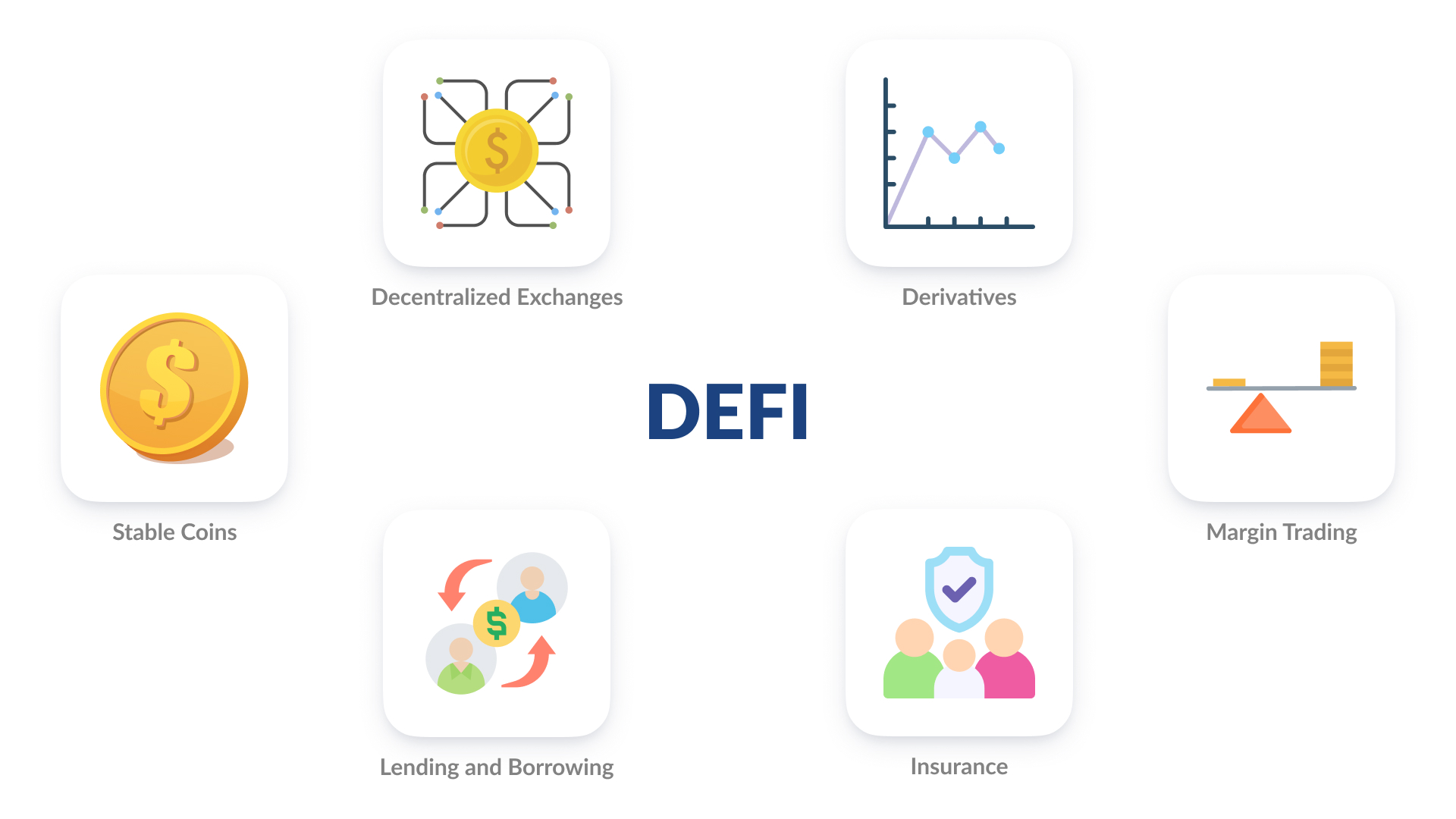

STFIL, built on the Filecoin network, had established itself as a leading player in the Decentralized Finance (DeFi) space. However, recent developments have cast a shadow over its operations. The exact nature of the investigation into the STFIL team remains unclear, but it has sent shockwaves through the DeFi ecosystem, particularly those invested in the project.

The news coincides with a broader Chinese government initiative targeting Filecoin equipment manufacturers. The authorities suspect these manufacturers of luring investors into purchasing Filecoin mining hardware with promises of exorbitant returns. These returns, according to the allegations, are unsustainable and constitute pyramid schemes. The crackdown has resulted in widespread arrests, further dampening investor sentiment in the Filecoin space.

Adding to the anxieties, a substantial transfer of STFIL's FIL tokens from the project's associated wallets to an unknown address has been flagged. While the purpose and recipient of this transfer remain undisclosed, it has fueled speculation and unease within the STFIL community. The lack of transparency surrounding the token transfer has exacerbated the concerns stemming from the ongoing investigation.

The STFIL situation has significant implications for the DeFi landscape in China. With a prominent project facing scrutiny, it is likely to trigger a period of increased regulatory oversight within the DeFi sector. This could potentially lead to stricter regulations and a more cautious approach from investors towards DeFi projects operating in China.

The global DeFi community is also closely monitoring the developments surrounding STFIL. The project's fate could set a precedent for how authorities in other countries approach DeFi projects. The potential for increased scrutiny across the world underscores the need for DeFi projects to prioritize transparency and adhere to established financial regulations.

As investigations unfold, the future of STFIL remains uncertain. The project's ability to navigate this crisis and regain investor confidence will depend on its transparency in addressing the ongoing probe and providing clarity regarding the FIL token transfer.