The Saudi Export-Import Bank (Saudi EXIM Bank) and its Swiss counterpart signed a significant agreement to bolster Saudi Arabia's non-oil exports and enhance their competitiveness in the global marketplace. This strategic move signifies a growing trade relationship between the two nations.

The agreement, signed in Zurich, Switzerland, establishes a reinsurance pact between Saudi EXIM Bank and the Swiss Export Credit Agency. Reinsurance essentially acts as insurance for insurance companies, providing additional security and risk mitigation. This collaboration will equip Saudi exporters with more robust financial protection as they navigate international markets.

This development comes on the heels of another agreement signed by Saudi EXIM Bank with a consortium of leading global reinsurers, spearheaded by Swiss Re, also headquartered in Zurich. These combined efforts aim to streamline export financing processes and offer comprehensive risk coverage for Saudi businesses venturing into foreign markets.

The pact between Saudi Arabia and Switzerland holds particular significance considering the current makeup of their bilateral trade. While the trade relationship boasts healthy figures, with Saudi exports to Switzerland reaching $810.67 million in 2023, the balance is currently skewed. Switzerland exported a substantially higher value of goods to Saudi Arabia, totaling $6.77 billion in the same year. Pearls, precious metals, and aluminum were the primary Saudi exports to Switzerland.

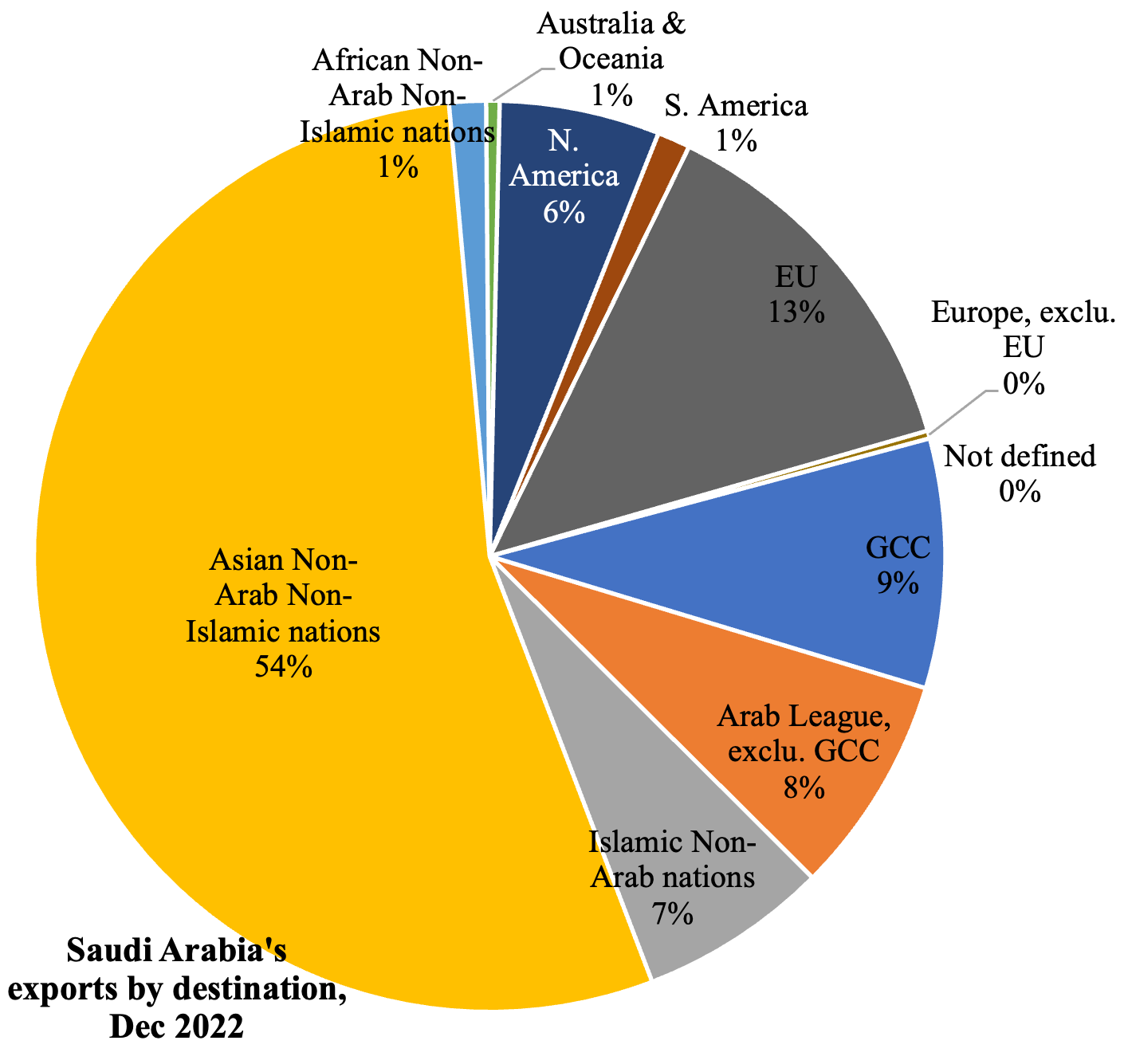

The Saudi EXIM Bank views this agreement as a critical instrument to achieve its core objective of diversifying the Saudi economy and reducing dependence on oil exports. By facilitating non-oil exports and empowering Saudi businesses on the global stage, the bank aspires to create a more robust and sustainable economic landscape for the Kingdom.

This strategic partnership extends beyond the immediate realm of trade finance. It represents a broader commitment by both nations to foster closer economic ties and collaboration. The agreement paves the way for increased investment opportunities, knowledge exchange, and potential joint ventures across various sectors.

Analysts predict that this agreement will act as a catalyst for a significant uptick in Saudi non-oil exports to Switzerland and potentially other European markets. The enhanced financial security and risk mitigation measures offered by the reinsurance pact are expected to incentivize Saudi businesses to explore new export opportunities with greater confidence.

The Saudi-Swiss trade pact signifies a new chapter in the economic relationship between the two nations. By fostering a more supportive environment for Saudi non-oil exports, this agreement holds the potential to unlock significant economic growth and diversification for the Kingdom.