Tokyo's stock market experienced a significant decline on Friday, with the Nikkei index suffering its worst single-day drop in nearly three years. The primary culprit behind the sell-off? A resurgent yen. The Japanese currency's appreciation against the US dollar squeezed profits for export-reliant companies, fueling investor anxieties.

The benchmark Nikkei 225 shed a hefty 960.90 points, translating to a 2.42% loss, settling at 38,812.24. The broader Topix index mirrored the Nikkei's descent, closing down 2.20% at 2,666.83.

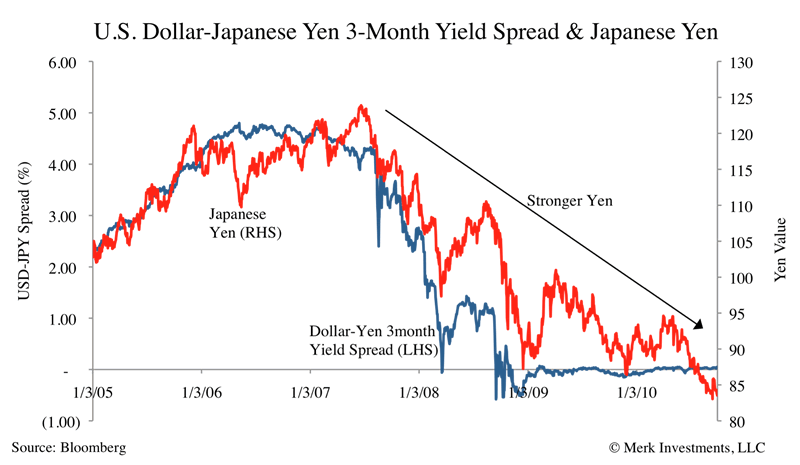

The market jitters stemmed from a two-pronged attack. Firstly, the yen's recent rise against the dollar eroded the competitiveness of Japanese exports. A stronger yen makes Japanese goods more expensive overseas, potentially denting foreign profits when repatriated. Companies like Toyota Motor and Komatsu, giants in the auto and machinery sectors respectively, witnessed significant stock price declines as a result.

Secondly, the ongoing tensions in the Middle East cast a shadow over global markets, including Tokyo. Investors, ever wary of geopolitical instability, opted for caution, further contributing to the selling pressure.

This slump comes amidst a backdrop of recent gains for the Tokyo market. The Nikkei had been on an upward trajectory in the preceding weeks, fueled by optimism surrounding advancements in artificial intelligence. However, the confluence of a resurgent yen and geopolitical tensions brought this rally to a screeching halt.

Analysts cautioned against overreacting to the sudden drop. They pointed out that the correction could be a much-needed adjustment after the Nikkei's rapid ascent. While acknowledging the headwinds from the yen's appreciation, some analysts expressed confidence in the long-term prospects of the Japanese market, citing factors like ongoing technological innovation and potential domestic demand growth.

The future trajectory of the Tokyo market remains to be seen. Whether the current decline signifies a more prolonged correction or merely a temporary setback hinges on several factors, including the yen's exchange rate and the evolution of the geopolitical landscape. Investors will be closely monitoring these developments in the coming days and weeks.