Abu Dhabi's sovereign wealth fund,ADQ,has tapped into the capital markets by listing a $2.5 billion bond on the London Stock Exchange (LSE).This move signifies the continued confidence of international investors in the emirate's robust economy and its strategic position as a global investment hub.

The bond issuance,which consists of two tranches with maturities of five and ten years,reflects ADQ's prudent financial management and its commitment to diversifying its funding sources.The proceeds from the bond sale will be directed towards financing the fund's ongoing investments and growth initiatives across various sectors,potentially including infrastructure,technology,and healthcare.

Financial analysts view ADQ's decision to list the bond on the LSE as a strategic one.The LSE is a well-established and deep financial market,attracting a diverse pool of international investors.By listing on the LSE,ADQ gains access to a wider investor base and benefits from the exchange's reputation and regulatory framework.

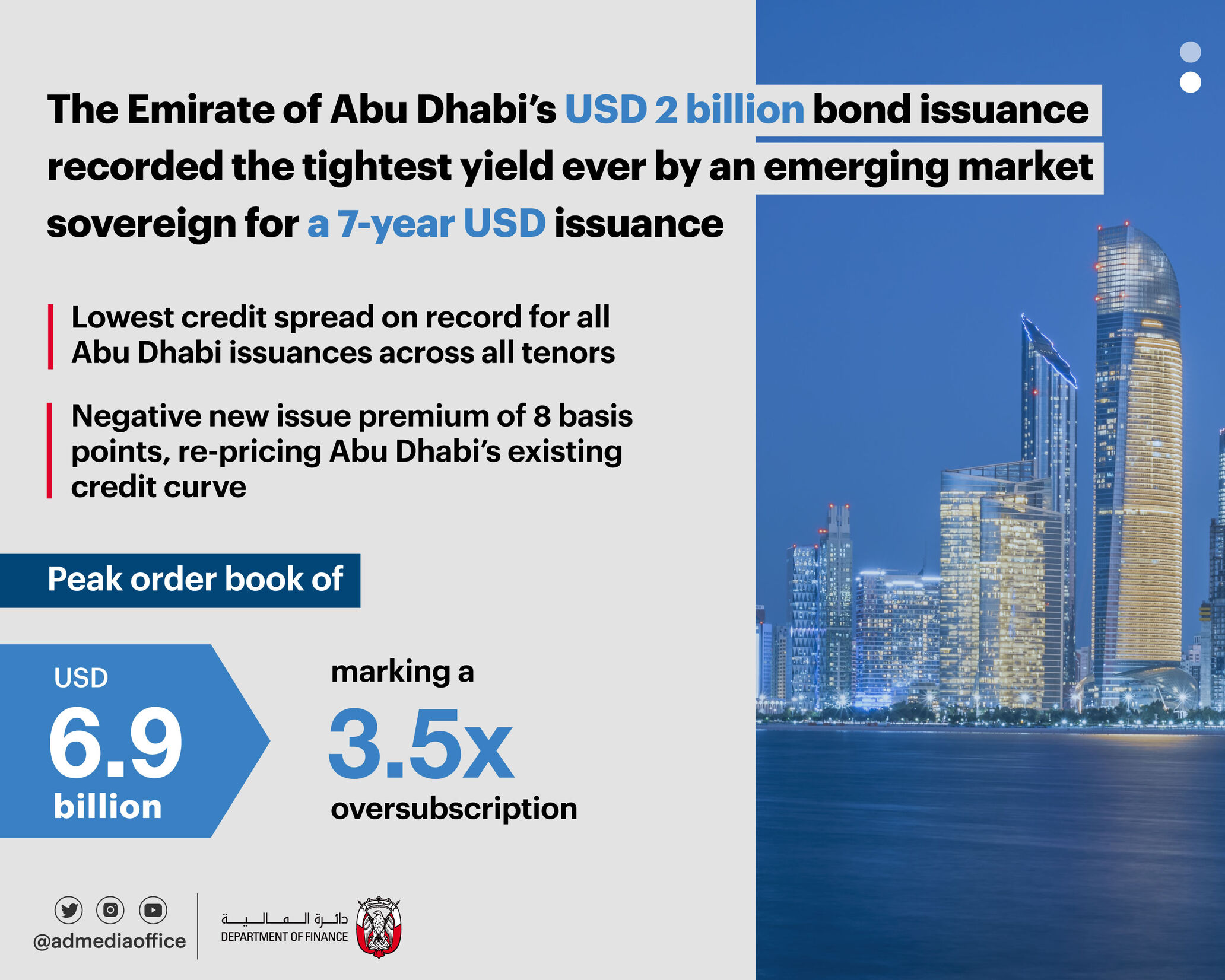

The successful issuance of the bond is a testament to ADQ's strong creditworthiness.Investors have shown confidence in the fund's ability to meet its financial obligations,as evidenced by the competitive interest rates secured on the bond offering.This positive reception further strengthens ADQ's position as a reliable and creditworthy investment partner.

Looking ahead,ADQ's bond issuance on the LSE paves the way for further financial activities in the international capital markets.The emirate's strategic vision,coupled with ADQ's sound financial management,is likely to attract more foreign investments,contributing to the continued growth and diversification of Abu Dhabi's economy.