Oil markets received a dose of unexpected caution on Wednesday after investment bank Goldman Sachs revised its forecast for the upcoming meeting of the Organization of the Petroleum Exporting Countries and allies (OPEC+). Previously, Goldman Sachs anticipated a partial rollback of the group's current production cuts. However, in a statement released on May 8th, the bank cited a recent uptick in global oil inventories, prompting them to adjust their model. Their revised outlook now predicts only a 37% chance of OPEC+ announcing an increase in production when they convene in June.

This shift in perspective from Goldman Sachs is significant, given the bank's established influence within the energy sector. The prospect of a continued production cut from OPEC+ could potentially bolster oil prices, which have fluctuated considerably in recent months. Geopolitical tensions and supply chain disruptions have driven prices upwards, while concerns about a potential global recession have exerted a countervailing downward pressure.

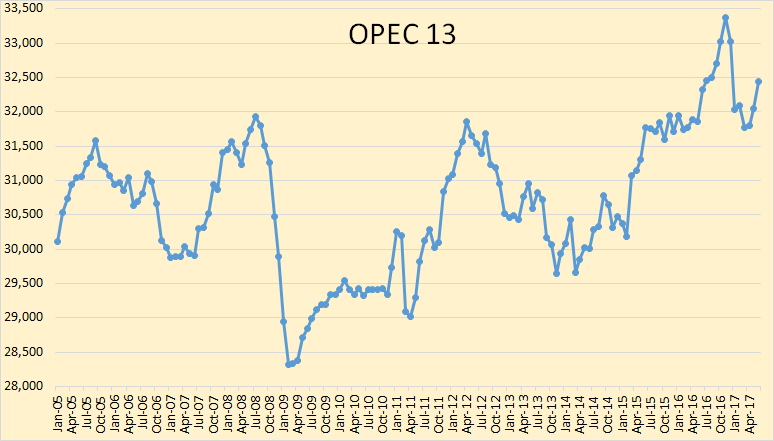

OPEC+, a powerful alliance comprising OPEC member states and a select group of non-member oil producers, has implemented production cuts since 2020 in response to the COVID-19 pandemic's crippling effect on global energy demand. The strategy proved successful in stabilizing the oil market, but with resurgent demand and a transformed geopolitical landscape, questions have arisen regarding the long-term sustainability of these production cuts.

The potential for a continued production cut by OPEC+ has drawn mixed reactions from various stakeholders. Oil-producing nations within the alliance stand to benefit from the potential for sustained high prices. Conversely, consumer nations, already grappling with inflationary pressures, could face further strains at the pump. Additionally, a continued production cut could exacerbate concerns about global energy security, particularly in regions heavily reliant on imported oil.

Looking ahead, the upcoming OPEC+ meeting in June will be closely watched by industry analysts and policymakers alike. The group's decision on production levels will have a significant impact on global oil prices, with potential ramifications for consumer spending, inflation, and the broader health of the global economy. While Goldman Sachs' revised forecast suggests a continued cautious approach from OPEC+, the final decision will hinge on a complex interplay of market forces, geopolitical considerations, and the group's internal dynamics.