The Philippine financial landscape is set to see a digital innovation with the Bangko Sentral ng Pilipinas (BSP) approving PHPC, a peso-pegged stablecoin launched by the popular crypto exchange Coins. ph. This move is expected to significantly impact the way Filipinos, particularly overseas workers, send money back home.

Traditionally, sending money to the Philippines has involved remittance centers or bank transfers, both of which can be slow and expensive. PHPC, however, promises faster, cheaper, and more convenient transactions. Designed to maintain a steady value by being pegged 1:1 to the Philippine peso, PHPC eliminates currency fluctuations often encountered with other cryptocurrencies. Coins. ph assures users that the stablecoin is backed by cash and cash equivalents held in Philippine bank accounts, guaranteeing a secure way to convert digital tokens back to pesos.

This BSP-approved pilot program positions PHPC as the first Philippine peso-backed stablecoin available for everyday use. Initially launched on the Coins. ph platform, the aim is to expand its reach to other platforms, creating a wider network for Filipinos to leverage its benefits. Faster transaction times and 24/7 accessibility are key features that address the limitations of traditional remittance methods.

The potential of PHPC goes beyond individual users. Businesses can also benefit from this innovation by streamlining cross-border payments. The efficiency and cost-effectiveness offered by PHPC could incentivize businesses to adopt this new financial tool.

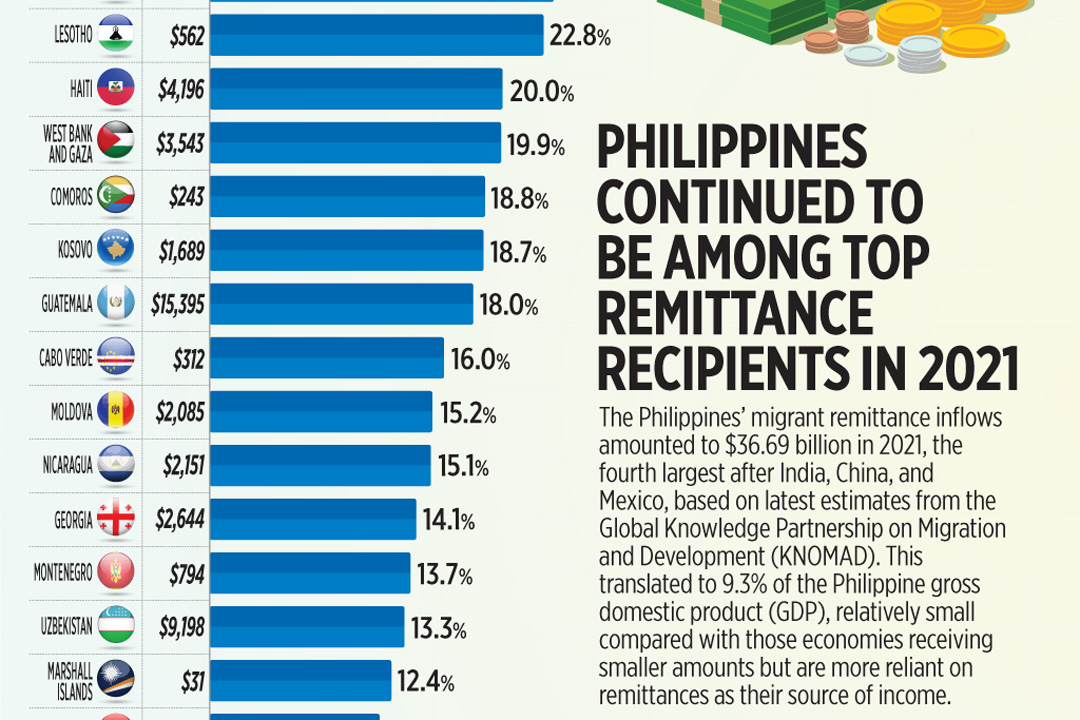

While the pilot program targets 20, 000 to 30, 000 users in the initial phase, the potential impact on the remittance industry is substantial. The Philippines is a world leader in receiving remittances, with billions of dollars flowing into the country annually. PHPC has the potential to disrupt this sector by offering a faster, cheaper, and more secure alternative to existing remittance channels.

The BSP's approval of PHPC signifies a forward-thinking approach to embracing financial technology. This pilot program paves the way for further exploration of blockchain technology and its potential to revolutionize the Philippine financial system. As the program progresses, it will be interesting to see how PHPC is adopted by Filipinos and how it reshapes the remittance landscape.