Bitcoin miners are facing intensified competition as the metric used to measure their profitability, hashprice, experiences significant swings. The hashrate, which represents the combined computational power dedicated to securing the Bitcoin network, recently surged past 600 exahash per second (EH/s) before settling around 598 EH/s. However, the hashprice, which reflects the anticipated daily earnings for each petahash (PH/s) of hashing power, currently sits at a precarious $57.

This represents a substantial drop from the period between March and April, where miners were enjoying a hashprice of at least $100 per PH/s daily. For context, a single PH/s is equivalent to the combined power of roughly five Bitmain Antminer S21 units, each boasting 200 terahash per second (TH/s). This translates to a quadrillion hashes computed every second – a staggering amount of processing power.

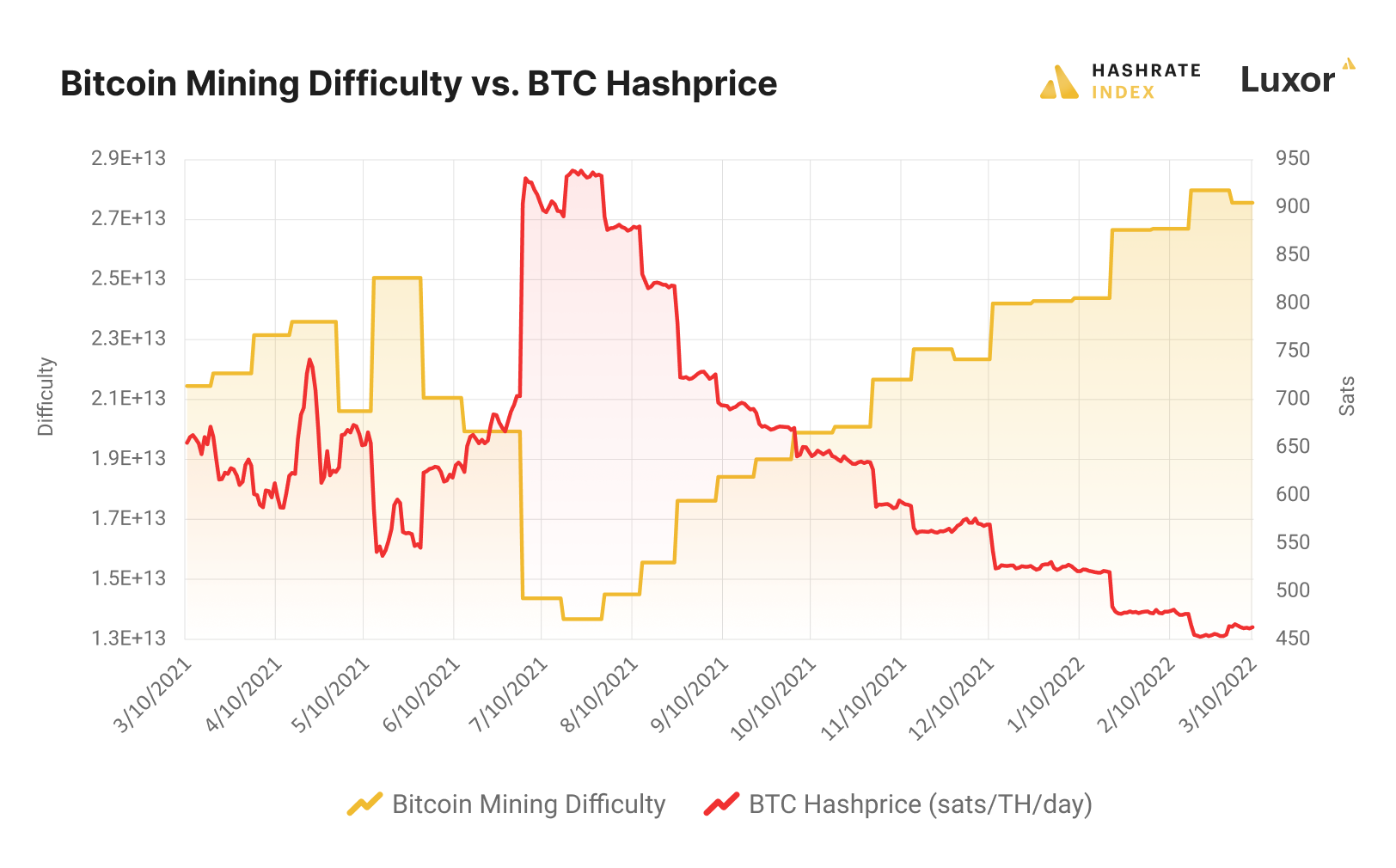

Since May, the hashprice has fluctuated between $44 and $57, with a fleeting peak of $94 on June 8th. This volatility has squeezed miner margins, forcing less efficient operations out of the game and solidifying the position of industry leaders. The recent hashrate increase suggests that new, more powerful mining rigs are coming online, further intensifying the competition for block rewards.

The Bitcoin network functions on a proof-of-work system, where miners compete to solve complex mathematical puzzles to validate transactions and add new blocks to the blockchain. The first miner to solve the puzzle wins the right to add the block and claim the associated block reward, currently set at 6. 25 bitcoins. With a fixed supply of 21 million bitcoins, these block rewards are halved roughly every four years, putting additional pressure on miners' profitability as time progresses.

The fluctuating hashprice underscores the inherent risk involved in Bitcoin mining. Miners require significant upfront investments in specialized hardware and substantial amounts of electricity to power their operations. When the hashprice dips, these fixed costs become a larger burden, potentially pushing smaller miners into the red.

This dynamic incentivizes miners to constantly seek ways to optimize their operations. This can involve deploying more efficient mining rigs, negotiating cheaper electricity rates, or joining mining pools to share resources and increase their chances of winning block rewards.

The current situation presents a potential turning point for the Bitcoin mining industry. While established players may benefit from the consolidation, the overall health of the network hinges on a diverse and competitive mining landscape. It remains to be seen how miners will navigate this period of volatility and whether the industry can adapt to ensure its long-term sustainability.