European Central Bank (ECB) officials are urging for patience in regards to further interest rate reductions. This comes after a recent cut in January, aimed at bolstering the Eurozone's sluggish economy. However, central bank policymakers are emphasizing a data-driven approach, prioritizing inflation control alongside economic growth.

President Christine Lagarde, during a press conference, reiterated the ECB's commitment to its primary objective of maintaining price stability. While acknowledging recent signs of easing inflation, she cautioned against prematurely shifting towards monetary loosening. Lagarde emphasized that the Governing Council, the ECB's decision-making body, remains "data dependent, not date dependent. "

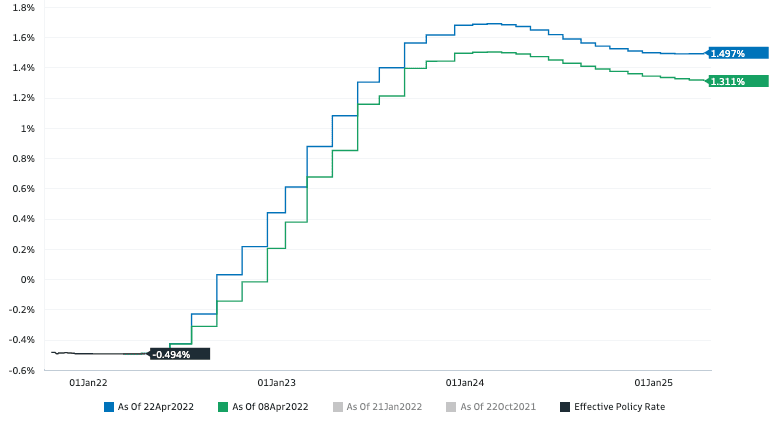

This stance comes amidst market speculation of a potential rate cut as early as June. Some ECB officials had previously hinted at this timeframe, but Lagarde's comments suggest a more cautious approach. The central bank is keenly awaiting data on negotiated wages, a crucial indicator of underlying inflationary pressures. These figures, typically available by late April, will provide valuable insights for the June policy meeting.

The ECB's recent rate cut marked a shift from previous months of tightening. Lagarde acknowledged the evolving economic landscape, with softening growth prospects prompting the policy change. However, she stressed that the central bank's commitment to combating inflation remains unwavering.

The wait-and-see approach adopted by the ECB reflects a delicate balancing act. While growth concerns necessitate support for the Eurozone economy, policymakers remain vigilant against reigniting inflationary pressures. The central bank is aiming for a "soft landing, " where inflation is brought under control without triggering a recession.

This cautious stance by the ECB aligns with recent actions by other central banks. The Federal Reserve in the United States, for instance, has also signaled a more measured approach to future rate hikes. This global shift reflects a growing recognition of the intertwined challenges of inflation and economic slowdown.

The ECB's decision to pause on further rate cuts has implications for the Eurozone's financial markets. Investors anticipating a swift easing cycle may need to adjust their strategies. The central bank's emphasis on data dependence suggests that future policy decisions will hinge on incoming economic indicators, particularly those related to inflation.

Looking ahead, the ECB's monetary policy path will be closely scrutinized. The central bank faces the task of navigating a complex economic environment, where inflation remains a concern but growth momentum is also weakening. The success of its strategy will hinge on its ability to strike a balance between these competing objectives.