A recent report by Capital Economics, a prominent UK-based research firm, paints a rosy picture for the economic outlook of Gulf countries. The report predicts a significant uptick in economic growth across the region, fueled by a projected increase in oil output and a relaxation of interest rates.

While the global economic landscape remains somewhat precarious, the Gulf economies are expected to benefit from a confluence of positive factors. The key driver for this growth surge is the anticipated rise in oil production. The Organization of the Petroleum Exporting Countries (OPEC) recently announced production cuts that will remain in place until September. However, Capital Economics forecasts an output increase in the latter part of 2024, extending into 2025 and 2026. This upswing in oil production aligns perfectly with the ongoing global recovery from the recent economic slowdown, leading to a potential surge in oil demand.

The report acknowledges that the immediate economic growth for 2024 might be slightly slower than previously anticipated due to the OPEC production cuts. Saudi Arabia, a regional powerhouse, is projected to see a modest 1. 3% growth this year. However, the outlook brightens considerably in the coming years. Capital Economics predicts a significant acceleration in Saudi Arabia's GDP growth, reaching 4. 5% and 4. 8% in 2025 and 2026, respectively, driven by the anticipated oil output boost.

Another factor contributing to the optimistic forecast is the expected easing of interest rates. The report suggests that central banks in the Gulf countries are likely to implement interest rate cuts in the coming months. This move would stimulate borrowing and investment, further propelling economic activity. The UAE, another prominent Gulf economy, is expected to witness a similar growth trajectory. The report predicts a 3. 3% GDP growth for the UAE in 2024, accelerating to a robust 5. 5% in 2025. The UAE's strong financial reserves, demonstrated by recent government bond issuances and the successful Aramco share sale, position it well to capitalize on the economic upswing.

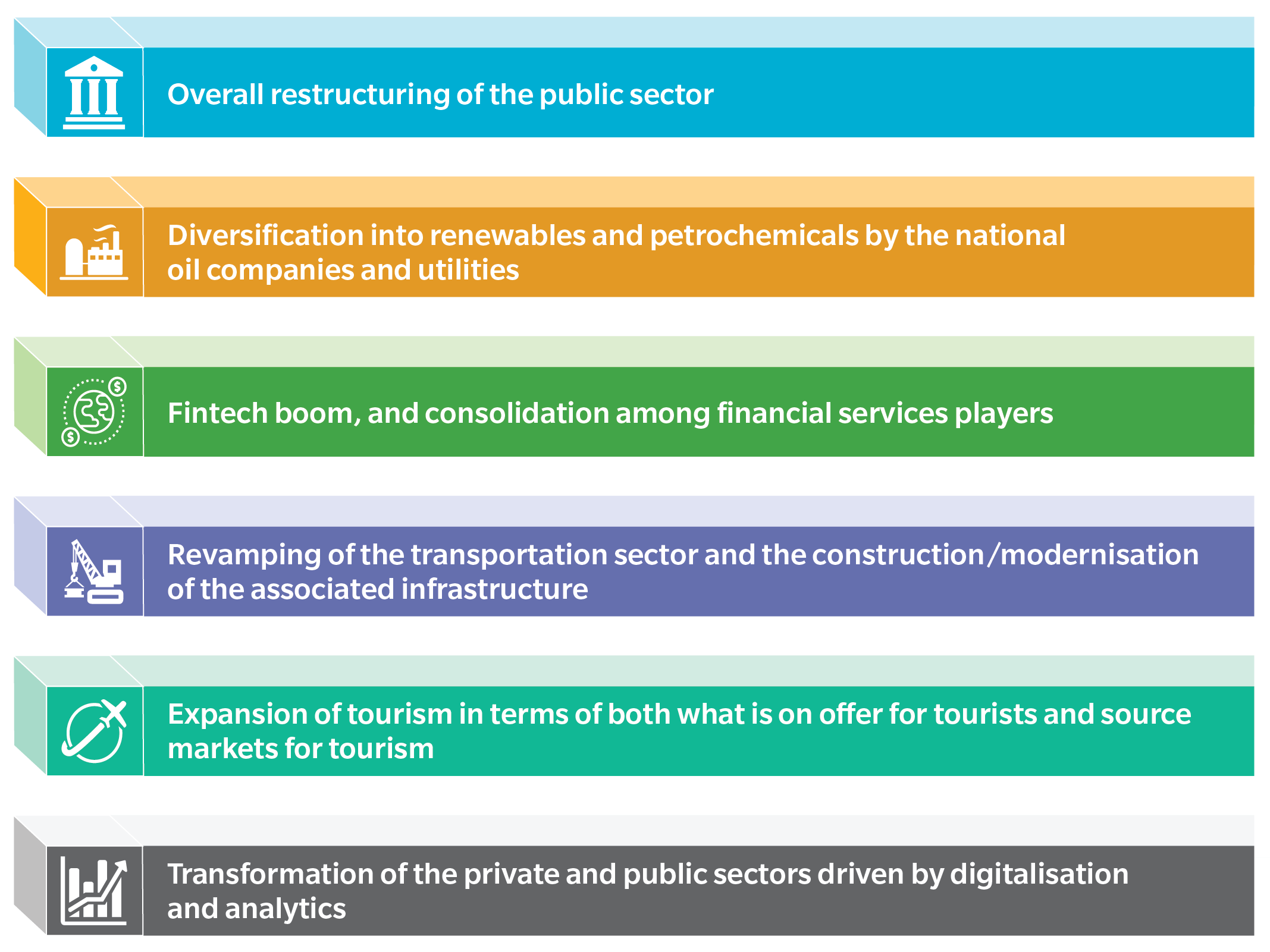

While the Capital Economics report offers a positive outlook, it also acknowledges potential challenges. Geopolitical tensions and ongoing global economic uncertainties could pose risks to the region's growth prospects. However, the report underscores the resilience of the Gulf economies, particularly given their dependence on oil revenue and their proactive economic diversification efforts. Overall, the report by Capital Economics provides a compelling case for a period of robust economic growth in the Gulf countries, driven by a combination of rising oil output and accommodative monetary policies.