Oil prices received a cautious boost after a significant buying spree by oil funds. This comes on the heels of reassurances from the Organization of the Petroleum Exporting Countries and its allies (OPEC+). The move indicates a potential shift in investor sentiment, which had leaned heavily towards a bearish outlook in recent weeks.

The positive shift follows a period of heavy selling by oil funds, who shed a staggering 194 million barrels the week prior. However, this trend reversed course dramatically. Recent data reveals purchases of roughly 68 million barrels of crude oil, alongside significant buying in related contracts. This buying spree has managed to recoup approximately 40% of the previous week's losses.

This newfound optimism stems directly from OPEC+'s recent announcement. The oil producer alliance surprised markets by revealing plans for a production increase starting in October. This decision suggests confidence within the group regarding future demand and a potential tightening of global oil supplies.

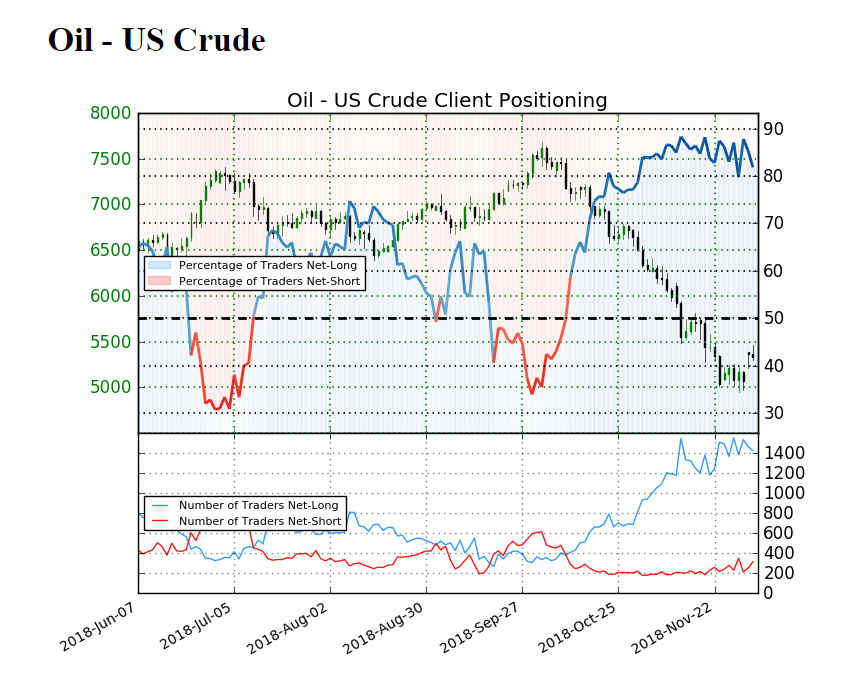

Despite the recent buying spree, a sense of cautiousness persists among investors. An analysis of investor positions across various oil contracts reveals a dominant undercurrent of bearish sentiment. A significant portion of these positions fall within the "bearish" to "very bearish" range, indicating a lack of widespread conviction about price increases later in the year.

Several factors continue to dampen investor enthusiasm. The substantial spare capacity held by OPEC+ members remains a major concern. This excess capacity signifies the group's ability to quickly ramp up production, potentially acting as a cap on future price hikes. Additionally, ongoing production growth from countries like the United States, Canada, Brazil, and Guyana is expected to further limit upward price movements.

The situation is further complicated by rising fuel inventories in the United States. Stockpiles of both gasoline and diesel have been exceeding seasonal trends, raising questions about actual consumer demand for these products. Tepid consumption growth across major markets like North America, Europe, and China adds another layer of uncertainty to the overall picture.

While the recent buying activity by oil funds suggests a tentative recovery in investor sentiment, the outlook for oil prices remains clouded. OPEC+'s production adjustments and potential demand growth offer a glimmer of hope, but concerns surrounding excess capacity and tepid fuel consumption act as significant counterweights. The coming months will be crucial in determining the direction of oil prices, with investor sentiment and market fundamentals playing a decisive role.