The OPEC+ group of oil-producing nations, led by Saudi Arabia and Russia, has signaled a move away from its previous strategy of maintaining high oil prices. The cartel recently announced a production deal that, while maintaining a complex system of quotas, paves the way for a significant increase in oil output over the next year and a half. This shift could have a substantial impact on global energy prices and inflation.

Previously, OPEC+ had been working to keep oil prices at or above $100 per barrel by limiting production. This strategy was motivated by a desire to boost revenue for member countries, many of which are heavily reliant on oil exports. However, the recent deal indicates a shift in priorities.

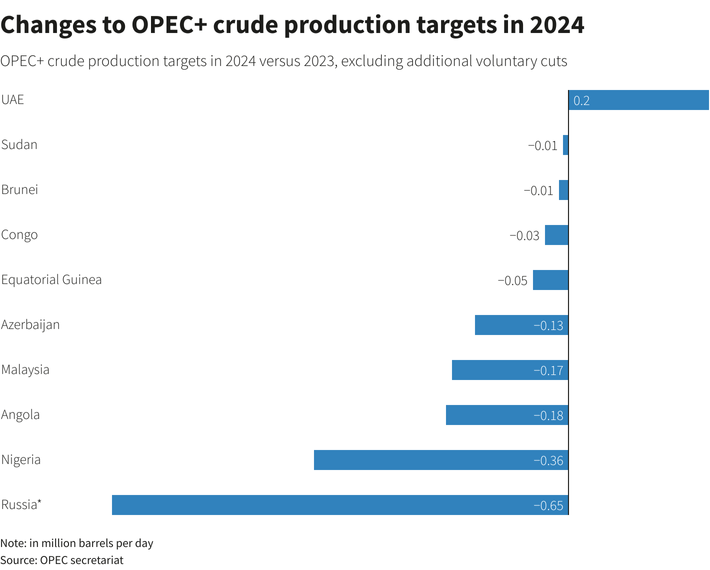

The new agreement allows member states to gradually increase production quotas starting in October 2024. These increases are expected to be substantial, with total OPEC+ output rising by over 500, 000 barrels per day by December and nearly 1. 8 million barrels per day by mid-2025. This significant rise in production is likely to lead to a decrease in oil prices.

There are several factors that may have contributed to OPEC+'s decision to move away from its $100 oil target. One key factor is likely the ongoing economic slowdown in China, the world's largest oil importer. Concerns about weakening Chinese demand have weighed on oil prices in recent months. Additionally, the United States has been pressuring OPEC+ to increase production in order to address high gasoline prices.

The decision by OPEC+ to increase production is likely to be welcomed by consumers around the world who have been grappling with high energy costs. Lower oil prices could lead to a decrease in gasoline prices and other transportation costs. This, in turn, could help to ease inflationary pressures that have been plaguing many economies.

However, the move could also have negative consequences for OPEC+ member states. A decrease in oil prices could lead to a decline in government revenue for these countries. This could force them to make difficult budgetary decisions in the coming years.

The long-term impact of OPEC+'s production shift remains to be seen. The global oil market is complex and influenced by a variety of factors. However, the decision to increase production is a significant development that could have far-reaching consequences for both oil producers and consumers.