Saudi Arabia's reign as a top oil exporter hit a snag in April, with crude shipments falling from a nine-month high reached in March. Data released by the Joint Organizations Data Initiative (JODI) on Monday revealed a 6. 9% decrease in exports compared to the previous month. This decline comes amidst a complex global energy landscape, marked by both potential production increases and economic headwinds.

The report indicated that Saudi Arabia exported 5. 968 million barrels per day (bpd) in April, down from 6. 413 million bpd in March. This decrease coincided with a slight rise in the country's crude oil production, which inched up to 8. 986 million bpd from 8. 973 million bpd the prior month. The data also highlighted a reduction in Saudi refineries' processing capacity, with crude throughput dipping to 2. 545 million bpd from 2. 56 million bpd. However, the report noted a contrasting trend in direct crude burning, which increased by 93, 000 bpd to 400, 000 bpd in April.

This development in Saudi Arabia's oil exports aligns with recent signals from the Saudi energy minister. Earlier this month, he emphasized OPEC+'s ability to adjust production levels in response to market fluctuations. The alliance, which groups the Organization of the Petroleum Exporting Countries (OPEC) and allies like Russia, can pause or even reverse production increases if the market weakens.

The news of declining exports follows Saudi Arabia's decision to lower the official selling price of its flagship Arab Light crude for July shipments to Asia. This move marked the first price cut in five months and fell within the lower range of industry expectations. The price reduction underscores the pressure faced by major oil producers like Saudi Arabia. This pressure stems from a combination of factors, including robust growth in non-OPEC oil supply and a global economy grappling with various challenges.

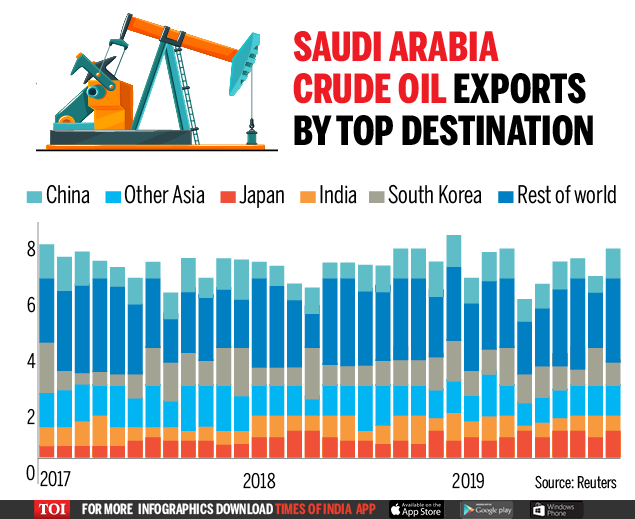

Despite the April dip in exports, Saudi Arabia remains the world's largest oil exporter. The recent developments highlight the dynamic nature of the global oil market, where producer decisions and external factors can significantly impact export volumes and pricing. As OPEC+ prepares for its upcoming policy meeting, all eyes will be on the alliance's strategy for navigating this complex energy landscape.