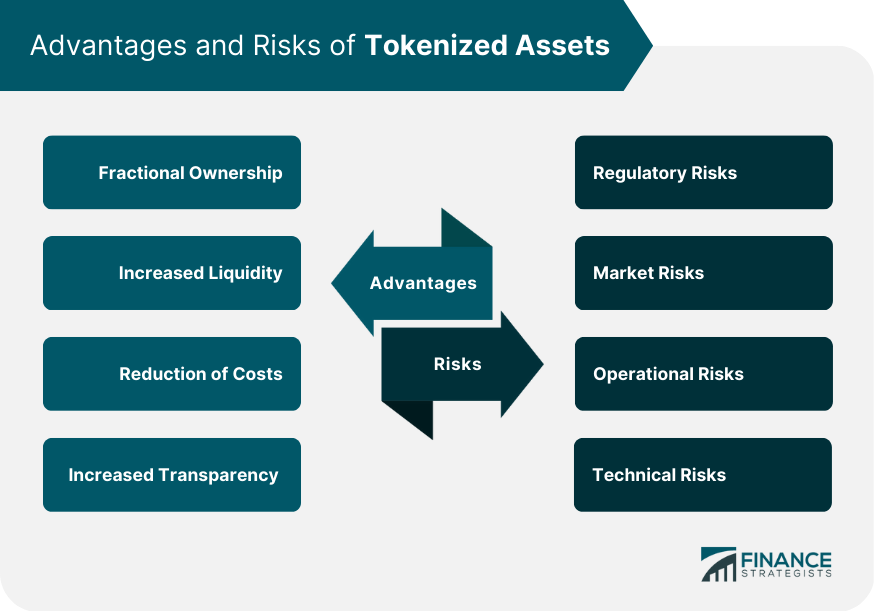

The burgeoning world of tokenized assets presents a captivating landscape for investors, offering fractional ownership, increased liquidity, and streamlined transactions. However, this innovation also carries inherent risks that require careful navigation. By understanding these unique challenges and implementing robust mitigation strategies, investors can participate in this evolving market with greater confidence.

One of the primary concerns lies in the nascent regulatory environment surrounding tokenized assets. Unlike traditional financial instruments, the regulatory framework for these digital representations of real-world assets remains unclear. This ambiguity can expose investors to unforeseen legal and compliance hurdles. To address this, staying informed about legislative developments and seeking guidance from qualified professionals versed in both traditional and blockchain-based finance is crucial.

Security breaches pose another significant threat. The decentralized nature of blockchain technology, while offering transparency, can also create vulnerabilities for malicious actors. Hacking incidents targeting DeFi protocols and cryptocurrency exchanges highlight the importance of robust security measures. Investors should prioritize platforms that employ rigorous cybersecurity practices, including secure storage solutions for private keys and regular smart contract audits.

Valuation of tokenized assets presents a distinct challenge. Unlike established markets with readily available pricing data, the valuation of tokenized assets can be less transparent. This opacity can lead to price manipulation and difficulty in accurately assessing the underlying value of the asset. Utilizing high-quality oracle services that provide reliable and tamper-proof data feeds is essential for informed investment decisions.

Furthermore, clear and unambiguous property rights are paramount in the tokenized asset ecosystem. The distributed ledger technology powering these assets requires robust legal frameworks that define ownership rights and transferability. Investors should carefully scrutinize the legal documentation associated with a tokenized asset offering to ensure a clear understanding of their rights and recourse mechanisms.

Liquidity, a key advantage of tokenized assets, can also be a double-edged sword. While tokenization facilitates fractional ownership and potentially increases the pool of potential buyers, the nascent nature of these markets can result in limited liquidity. Investors should be prepared for potential periods of illiquidity and ensure their investment strategy aligns with their risk tolerance.

In conclusion, navigating the exciting world of tokenized assets requires a keen understanding of the unique risks involved. By prioritizing regulatory compliance, robust security, transparent valuation methods, well-defined property rights, and a realistic perspective on liquidity, investors can mitigate these challenges and unlock the full potential of this transformative financial innovation.