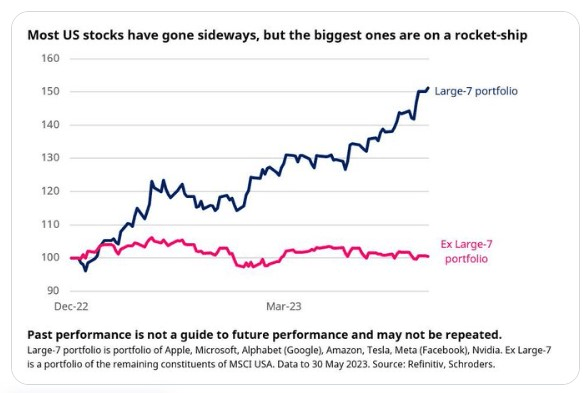

The sharp decline follows a period of heightened market volatility. Rising interest rates, geopolitical tensions, and concerns over the global economic outlook have all contributed to investor apprehension. The "Magnificent 7" stocks, which had previously driven substantial market gains, are now facing a tough market reality.

Apple, Microsoft, and Alphabet, which were among the top performers over the past year, have seen their stock values decrease significantly. Apple’s stock dropped amid concerns over supply chain disruptions and regulatory scrutiny. Microsoft faced investor skepticism regarding its growth prospects in the face of increasing competition in the cloud computing sector. Alphabet's challenges included regulatory pressures and shifts in the advertising market.

Amazon and Meta also experienced significant setbacks. Amazon's stock value declined as the company navigated the impacts of inflation on consumer spending and operational costs. Meta (formerly Facebook) faced difficulties in the wake of regulatory challenges and shifts in social media dynamics, which affected its advertising revenue streams.

Tesla, another key member of the "Magnificent 7," saw its stock value tumble after missing earnings expectations. This decline reflects broader concerns about the electric vehicle market and increased competition from established automakers entering the EV space.

Despite these losses, Nvidia, another key player within the group, has managed to perform relatively well compared to its peers. Nvidia's robust earnings report, driven by high demand for its graphics processing units (GPUs), provided some relief amidst the broader market downturn.

Market analysts suggest that this downturn may lead to a reevaluation of tech stock valuations. The concentration of market gains among a few high-performing stocks has raised questions about the sustainability of such growth. As these leading companies face headwinds, there is increasing scrutiny on their long-term growth strategies and ability to navigate an evolving economic landscape.

The broader impact on the S&P 500 index underscores the significance of the "Magnificent 7" stocks. Their outsized influence means that fluctuations in their stock prices have a pronounced effect on the overall market. Investors are closely watching the earnings reports and forward guidance from these companies, as they will be critical in shaping market sentiment in the coming months.

Overall, the recent market developments highlight the volatile nature of the current financial environment. While the "Magnificent 7" have been instrumental in driving market gains, they are also vulnerable to rapid shifts in investor sentiment and external economic pressures. As the market adjusts, the performance of these tech giants will remain a focal point for investors seeking to navigate the complexities of the modern financial landscape.

Topics

Cryptocurrency