Americana Group has received approval from the Abu Dhabi Securities Exchange (ADX) for a substantial share buyback program, authorizing the purchase of up to 25 million shares. This decision marks a significant strategic move for the company, reflecting confidence in its future performance and market stability.

The buyback program, which aims to repurchase approximately 10% of Americana's outstanding shares, is expected to bolster shareholder value and provide additional liquidity in the market. The company's management views this initiative as a proactive measure to enhance its stock performance amid fluctuating market conditions.

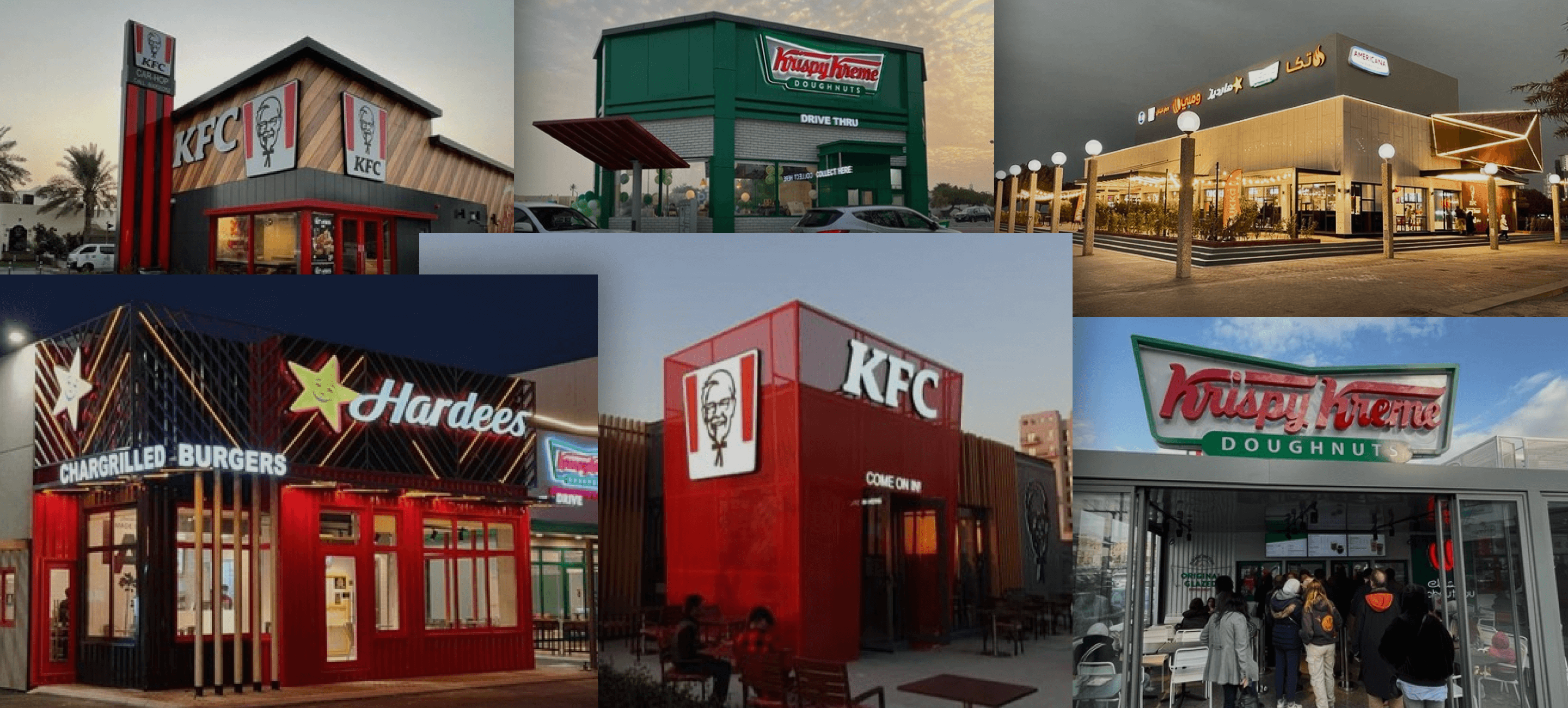

Recent financial disclosures reveal that Americana has experienced robust growth across its key business segments, including fast-food and retail operations. The company has been expanding its footprint in the Middle East and North Africa (MENA) region, leveraging its diverse portfolio to tap into emerging consumer markets. This growth trajectory has significantly strengthened its market position and financial health.

Americana's board of directors has articulated a clear strategy behind the buyback plan, emphasizing its potential to improve earnings per share (EPS) and overall shareholder returns. By reducing the number of shares in circulation, the company aims to increase the value of remaining shares, which could attract more investors and stabilize the stock price.

The approval from ADX also underscores the regulator's confidence in Americana's governance and financial stability. This move aligns with broader trends in the region, where companies are increasingly engaging in share repurchase programs to reinforce investor confidence and manage capital efficiently.

Investors and market analysts have responded positively to the announcement, noting that share buybacks can signal a company’s strong financial health and commitment to maximizing shareholder value. However, some experts caution that while buybacks can be beneficial, they should be balanced with strategic investments and growth initiatives to ensure long-term sustainability.

Americana's financial strategy, including the share buyback plan, reflects a broader trend among leading companies in the region aiming to optimize their capital structures and respond to market dynamics. As the company proceeds with its buyback program, stakeholders will be closely monitoring its impact on the stock performance and overall market sentiment.

The execution of the buyback will occur over a specified period, and Americana will be required to comply with regulatory guidelines and reporting requirements throughout the process. This transparency will be crucial in maintaining investor trust and ensuring the effective implementation of the program.

Overall, Americana’s approval for the buyback of 25 million shares is a notable development in the company's financial strategy. It highlights the firm's proactive approach to enhancing shareholder value and navigating the complexities of the current market environment.

Topics

UAE