The downstream sector, encompassing refining, chemicals, and marketing activities, has been under significant pressure. Recent reports indicate that lower margins and reduced throughput are contributing factors to the profit slump. The global economic slowdown and persistent volatility in energy markets have impacted refining margins, pushing them to narrower levels.

Aramco's profitability in the downstream sector, crucial for the company's diversified revenue stream, has been further strained by competitive market conditions. An oversupply of refined products in key markets and softer consumer demand have intensified the strain on margins. Moreover, geopolitical tensions and regulatory changes in major consuming regions are adding to the unpredictability of the downstream business.

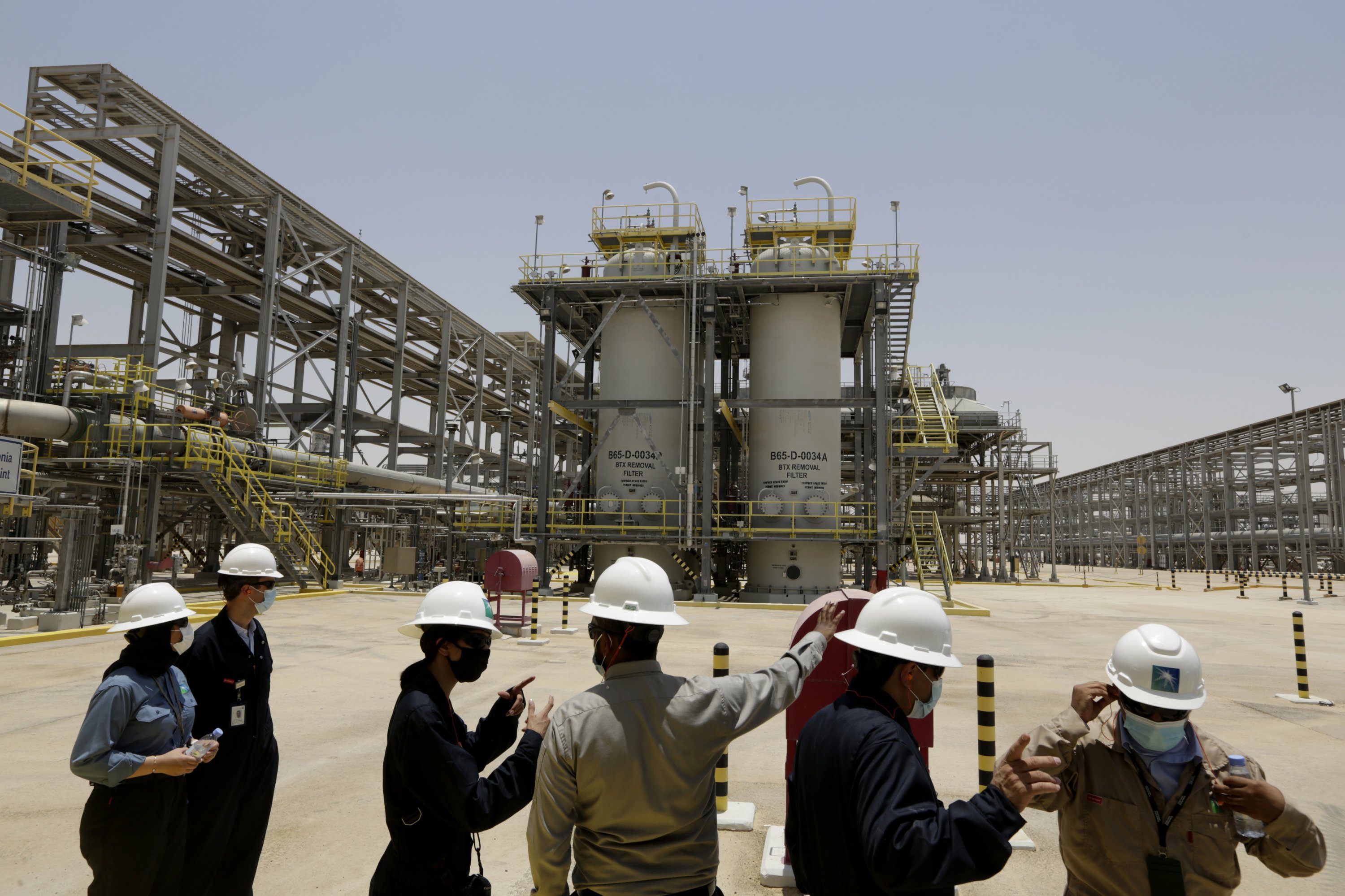

In contrast, Aramco's upstream activities, which include exploration and production of crude oil, have performed relatively well. The company's focus on maintaining high production levels and its strategic investments in key oil fields have supported its upstream revenue. Nevertheless, the weaker downstream performance is overshadowing these gains and affecting overall financial performance.

Market analysts are closely watching Aramco's upcoming financial disclosures for further insights into the company's strategies to address these challenges. Industry experts suggest that Aramco may need to bolster its downstream operations through technological advancements and strategic partnerships to navigate the current market environment.

The company's ongoing efforts to enhance operational efficiencies and optimize its downstream portfolio could play a pivotal role in mitigating the impact of market volatility. Aramco's strategic initiatives, including investments in new refining technologies and expanding its chemical product offerings, are expected to be crucial in revitalizing its downstream segment.

As Aramco prepares to release its earnings report, stakeholders are keen to understand how the company plans to tackle the current downturn in its downstream operations and what measures it will implement to safeguard future profitability. The company's approach to balancing its upstream strengths with necessary downstream improvements will be closely scrutinized by investors and industry observers.

Overall, while Aramco's upstream performance offers a buffer against the downturn, the significant forecasted drop in downstream profit underscores the pressing need for the company to adapt and innovate in a challenging market landscape.

Topics

Spotlight