Over the past week, U.S. stock markets have experienced a series of losses, largely attributed to ongoing concerns about inflation and economic uncertainty. Major indices, including the S&P 500 and the Nasdaq, have shown consistent declines, reflecting investor apprehension about the broader economic climate and the Federal Reserve’s potential monetary policy adjustments. However, Friday's performance of the cryptocurrency sector stood in stark contrast to this trend.

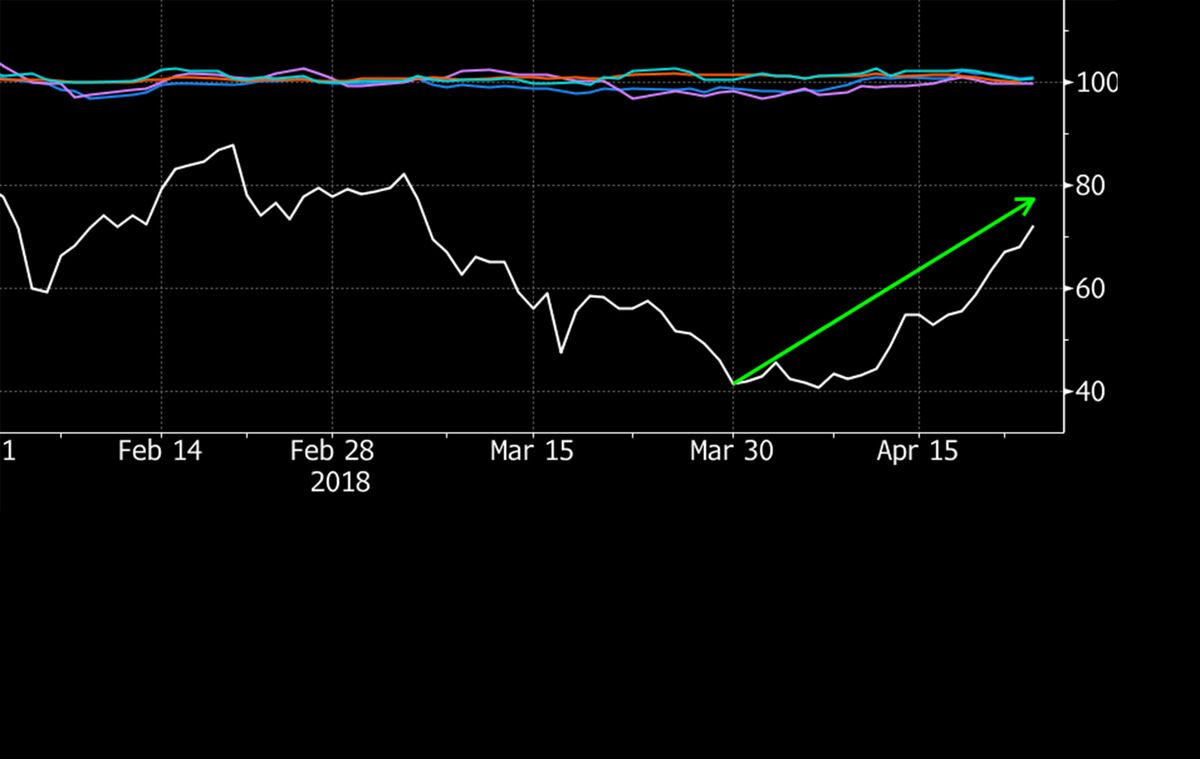

Bitcoin, the leading cryptocurrency, saw a notable increase of 7% within a 24-hour period, reaching levels not seen in several months. Ethereum and other altcoins also experienced substantial gains, contributing to the overall bullish sentiment in the digital asset space. This sudden uptick has intrigued market watchers who are keen to understand the underlying causes behind the crypto market's resilience in the face of a struggling equity market.

One contributing factor to this divergence could be the recent developments in global monetary policies. Central banks in various countries, including the U.S., have been navigating complex economic challenges, with some considering policy adjustments to address inflationary pressures. Meanwhile, the cryptocurrency market has been influenced by different dynamics, including institutional adoption, technological advancements, and regulatory developments that are less directly tied to traditional financial markets.

Furthermore, the growing acceptance of cryptocurrencies by institutional investors has played a significant role in bolstering the market. Several high-profile financial institutions have recently announced increased investments in digital assets, providing a vote of confidence in the sector and potentially driving up prices. This institutional interest, coupled with ongoing innovation in blockchain technology, may be fostering a more resilient and independent crypto market that can react differently compared to traditional assets.

The regulatory environment is also evolving, with various jurisdictions clarifying their stance on cryptocurrency transactions and trading. Recent positive developments, such as more favorable regulations in key markets, could be enhancing investor confidence and contributing to the rally. As governments and financial authorities work to integrate cryptocurrencies into existing financial frameworks, the market is likely to experience continued volatility but also opportunities for growth.

Analysts are watching the situation closely to gauge whether this rally represents a temporary anomaly or a sign of a more enduring shift in market dynamics. The potential for further decoupling between cryptocurrencies and traditional equities could have significant implications for portfolio diversification strategies and investment approaches.

Overall, while the cryptocurrency rally of Friday has defied the recent trends observed in U.S. equities, it underscores the complex interplay between different asset classes and the evolving nature of financial markets. As digital assets continue to gain traction and institutional support, their relationship with traditional financial indicators will be a crucial area of focus for investors and analysts moving forward.

Topics

Cryptocurrency