The agreement is expected to boost financial stability and liquidity in both countries' markets, providing businesses with easier access to capital in their respective currencies. This move aligns with the broader strategy of both nations to enhance economic cooperation and support sustainable economic growth. The swap deal is part of a series of initiatives to promote the use of domestic currencies in international trade, reflecting a growing trend among emerging markets to reduce their reliance on dominant global currencies.

By enabling direct currency exchange, the agreement helps mitigate the impact of currency fluctuations and offers a more predictable environment for trade and investment. This is particularly beneficial for small and medium-sized enterprises (SMEs) that often face significant challenges in managing currency risks. The reduced transaction costs and improved access to financing in local currencies are expected to drive more robust trade activities and economic collaboration.

The currency swap deal also signals a deepening of financial cooperation between the UAE and Egypt, with potential implications for other sectors. Both nations have been working towards enhancing their financial systems' resilience and efficiency, and this agreement is a testament to their commitment to fostering a more integrated and cooperative economic landscape.

Furthermore, the swap agreement reflects a strategic shift towards greater economic independence and regional collaboration. As global economic dynamics continue to evolve, emerging markets like the UAE and Egypt are seeking to strengthen their financial ties and reduce their vulnerability to external shocks. By promoting the use of local currencies in bilateral trade, they are laying the groundwork for a more resilient and self-sustaining economic framework.

This agreement is not an isolated event but part of a broader trend in the region. Several countries have been exploring similar arrangements to bolster their economic ties and promote financial stability. The UAE, in particular, has been proactive in forging such partnerships, as evidenced by its recent agreements with other nations, including China and Turkey.

The UAE and Egypt's currency swap deal underscores the importance of regional cooperation in achieving economic stability and growth. As the global economy faces increasing uncertainties, such agreements provide a valuable tool for mitigating risks and ensuring more predictable and stable economic interactions.

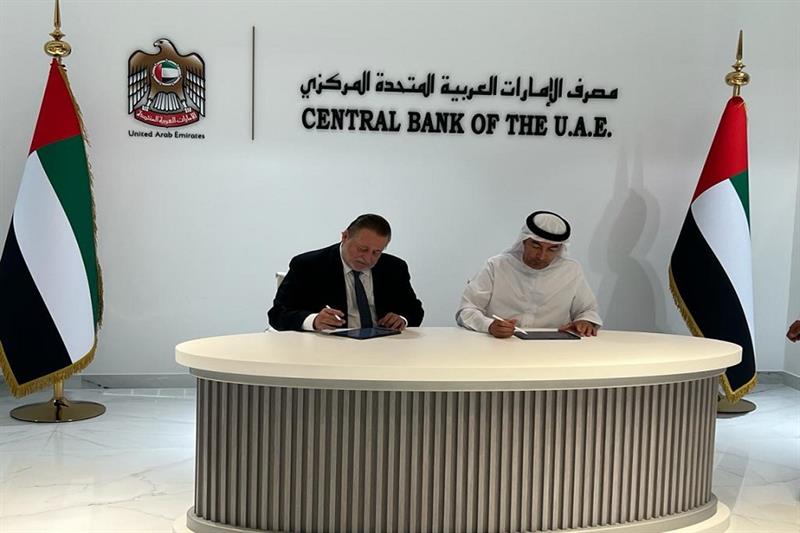

The currency swap agreement between the CBUAE and NBE marks a pivotal moment in the economic relationship between the UAE and Egypt. It highlights their commitment to enhancing financial cooperation and supporting sustainable economic growth through innovative financial instruments. As more countries look to similar arrangements, this deal sets a precedent for how regional collaboration can drive economic resilience and stability.

Topics

Live News