Financial markets around the world scaled new heights on Friday, fueled by optimism about a potential interest rate cut in the United States and buoyed by the decisive victory of the Labour Party in the United Kingdom's general election. The positive sentiment overshadowed the upcoming French presidential run-off, which remained a point of focus for European investors.

The Labour Party's landslide win, ending 14 years of Conservative rule, initially dominated European markets. Sterling, the British pound, strengthened against the US dollar, and the UK's FTSE 100 index jumped in early trading. Analysts attributed this reaction to the Labour Party's victory providing a sense of stability and clarity for businesses navigating an uncertain global environment.

However, attention quickly shifted across the English Channel as investors awaited the release of the US non-farm payrolls report, a key indicator of American job growth. A slowdown in job creation could bolster the case for a rate cut from the US Federal Reserve, a move seen as positive for stock prices. Economists predicted a moderate increase of around 190, 000 jobs in June, following a surge of 272, 000 in May.

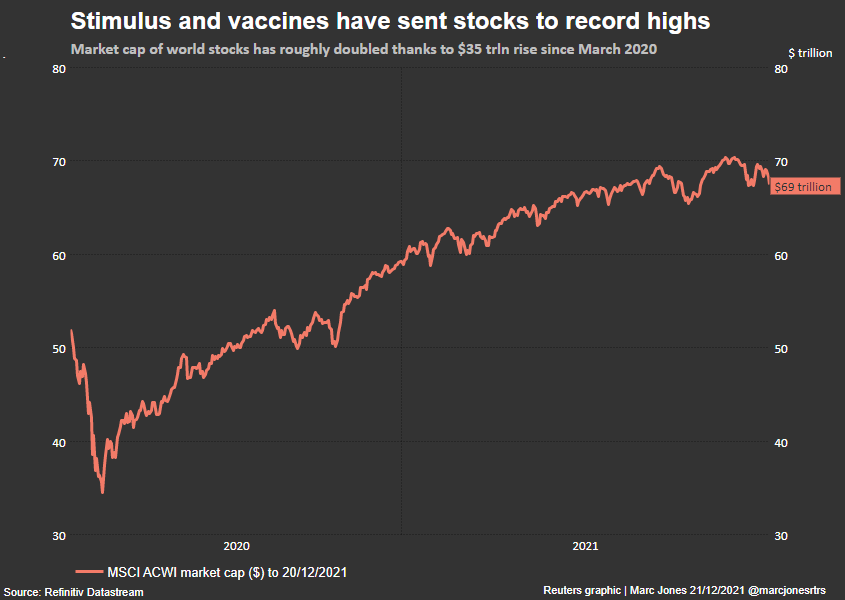

Meanwhile, global equity markets continued their upward trajectory. The MSCI World Stock Index, a broad gauge of global stock market performance, touched a fresh record high. European shares mirrored this trend, with the STOXX Europe 600 index rising by 0. 4%. Asian markets had set the tone earlier in the day, with Japan's Nikkei and the broader Topix index both achieving record highs.

The prospect of a US rate cut stemmed from recent signs of easing inflation pressures in the world's largest economy. This, coupled with a potential slowdown in job growth signaled by the payrolls report, could prompt the Federal Reserve to adjust its monetary policy to stimulate economic activity.

The upcoming French presidential election on Sunday remained a wildcard for European markets. The outcome of the vote, pitting incumbent President Emmanuel Macron against far-right challenger Marine Le Pen, could significantly impact investor sentiment in the region. A victory for Le Pen, whose policies are seen as less favorable for businesses, could trigger market volatility.

Despite these uncertainties, the overall mood in global financial markets remained upbeat on Friday. The combination of a decisive political shift in the UK, positive economic signals from the US, and record highs for global stocks painted a picture of an increasingly confident and optimistic investor landscape.