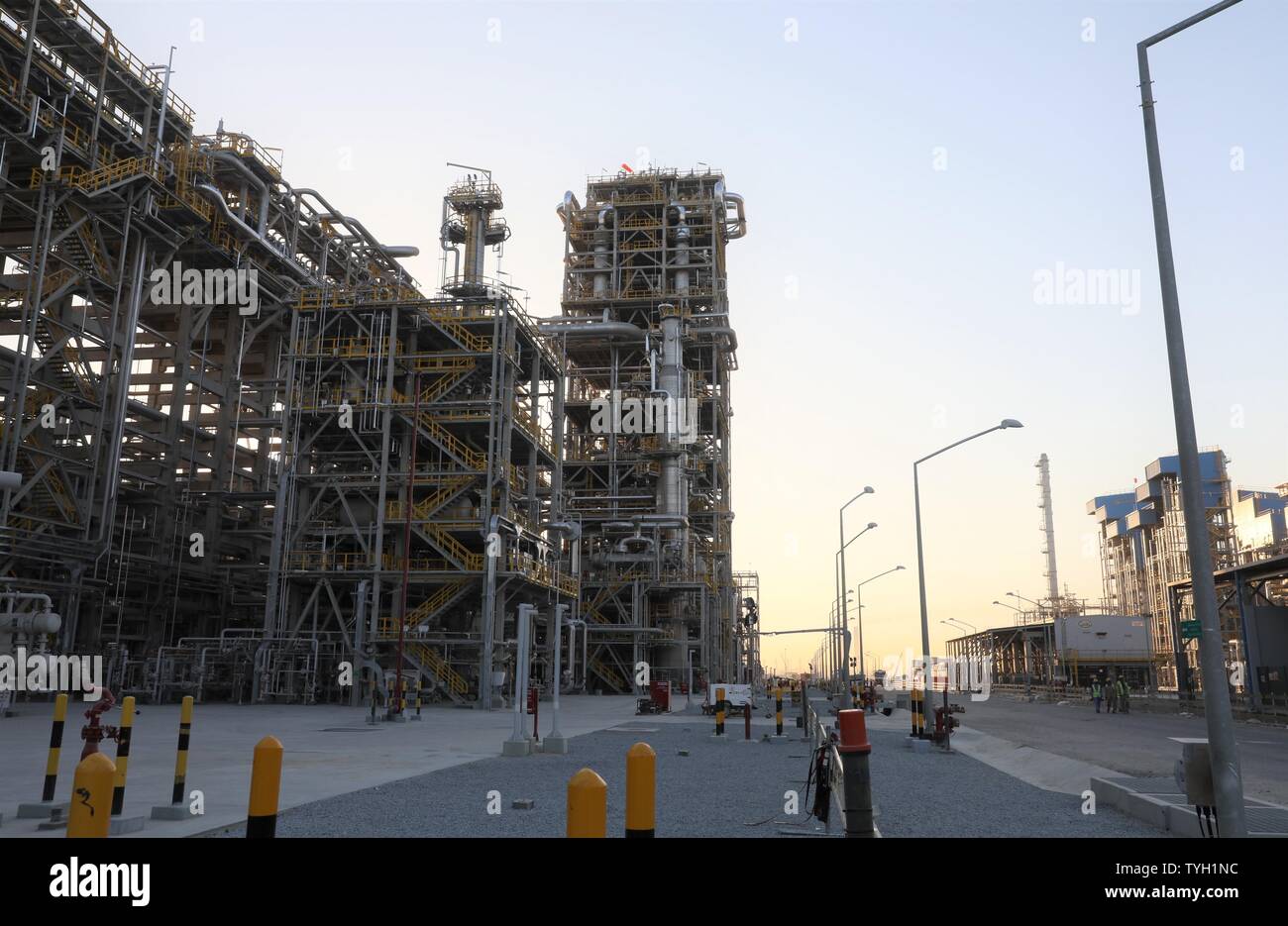

A wave of new contracts, primarily in the oil and gas sector, underscores Kuwait's strategic efforts to diversify its economy and bolster infrastructure. The Kuwait Authority for Partnership Projects (KAPP) has been pivotal in facilitating these investments, ensuring the smooth progression of numerous high-value projects. Among the key initiatives are the Al-Zour Refinery and the Clean Fuels Project, both instrumental in enhancing the country’s refining capabilities and meeting international environmental standards.

NBK’s analysis reveals that the current fiscal policies and increased government spending are fueling this upturn in project activity. This year alone, the Kuwaiti government has allocated substantial funds towards infrastructure development, including roads, ports, and healthcare facilities. These investments are part of Kuwait’s Vision 2035, a long-term development strategy aimed at transforming the country into a regional financial and cultural hub.

The oil sector remains a cornerstone of Kuwait’s economy, and the Kuwait Oil Company (KOC) is at the forefront of driving growth within this domain. The company’s expansion plans include the development of new oil fields and the enhancement of existing ones, ensuring sustained production levels. Additionally, Kuwait Petroleum Corporation (KPC) has announced significant investments in petrochemical projects, further diversifying the sector’s portfolio.

Beyond oil and gas, the construction sector is experiencing a boom, with several mega-projects underway. The Silk City project, a $132 billion endeavor, aims to create a new urban center in northern Kuwait, featuring residential, commercial, and leisure facilities. Another ambitious project is the Kuwait Metro, designed to alleviate traffic congestion and provide efficient public transportation.

Financial experts indicate that the banking sector plays a crucial role in supporting these projects through funding and advisory services. Local banks, including NBK, Gulf Bank, and Burgan Bank, have been actively involved in financing major developments, reflecting confidence in Kuwait’s economic prospects. This collaboration between the public and private sectors is vital for maintaining the momentum of project execution and ensuring timely completion.

Kuwait’s strategic geographic location and robust financial sector are attracting international investors, further bolstering the project landscape. Foreign direct investment (FDI) in Kuwait has seen a noticeable increase, with investors recognizing the potential for substantial returns in the burgeoning infrastructure sector. The government’s efforts to create a favorable business environment, including regulatory reforms and incentives, are paying off, drawing more global companies to participate in the country's growth story.

Economic analysts caution that while the outlook is positive, challenges such as fluctuating oil prices and geopolitical tensions could impact the pace of project execution. However, Kuwait’s prudent fiscal management and strategic vision provide a buffer against these uncertainties, ensuring that the country remains on a stable growth trajectory.

Kuwait’s commitment to sustainability and innovation is also shaping the future of its project landscape. The government is emphasizing the incorporation of green technologies and renewable energy sources in new developments. Initiatives like the Shagaya Renewable Energy Park, which aims to produce 15% of Kuwait’s energy from renewable sources by 2030, exemplify this forward-looking approach.

As Kuwait continues to award contracts and launch new projects, the outlook for the construction and energy sectors remains robust. The ongoing investments and strategic initiatives underscore the country’s determination to achieve its Vision 2035 goals, positioning Kuwait as a dynamic and resilient economy in the region.

Topics

Kuwait