The settlement, awaiting final court approval, marks a resolution to claims that Robinhood inundated users with unsolicited texts, violating regulations designed to protect consumers from intrusive marketing practices. According to court documents, the texts were sent without consent, prompting legal action against the fintech giant.

Legal proceedings revealed that the messages, which promoted various financial services and opportunities, were sent to users' mobile phones despite not having obtained explicit permission to do so. This action allegedly contravened Washington's strict laws governing consumer communications, which require companies to secure prior consent before sending promotional texts.

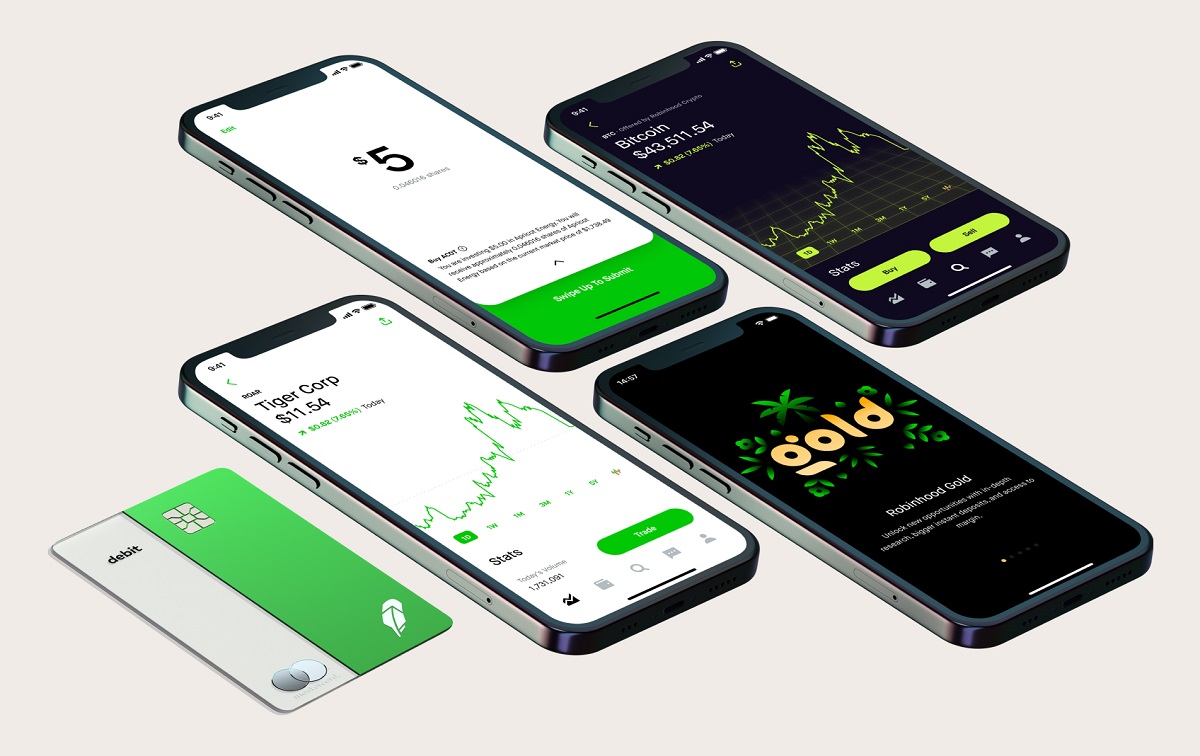

Robinhood, a prominent platform known for its user-friendly approach to investing, has agreed to pay affected consumers from the settlement fund. Additionally, the company has committed to enhancing its compliance measures to prevent similar incidents in the future.

Consumer advocates welcomed the settlement as a step towards holding corporations accountable for respecting consumer privacy and adhering to marketing regulations. The case underscored the importance of transparency and consent in digital communications, especially in the rapidly evolving landscape of financial technology.

In response to inquiries about the settlement, Robinhood emphasized its commitment to resolving the matter swiftly and fairly. The company acknowledged the impact of the litigation on its users and reiterated its dedication to upholding the highest standards of compliance moving forward.

The settlement agreement, if approved by the court, will provide compensation to eligible recipients who received the unauthorized texts during the specified period. Details on the claims process and distribution of funds will be finalized pending court approval, ensuring affected consumers are duly compensated for any inconvenience caused.

Industry analysts noted that such settlements underscore the risks companies face when navigating consumer protection laws in various jurisdictions. The case serves as a reminder for businesses to review their marketing practices and ensure strict adherence to regulatory requirements, particularly concerning digital communications.

As Robinhood continues to expand its services and user base, the resolution of this legal matter is expected to contribute to restoring trust and reinforcing compliance within the company's operations. The fintech sector, known for its rapid innovation and disruption, remains under scrutiny as regulators and consumers alike demand accountability and ethical conduct from market participants.

The $9 million settlement reflects a significant financial commitment by Robinhood to address the claims raised in the lawsuit and underscores the company's willingness to resolve legal challenges through negotiated agreements. Pending court approval, the settlement is poised to bring closure to a chapter of legal uncertainty for Robinhood and affected consumers alike.

Topics

Cryptocurrency