The IPO market in Saudi Arabia has seen significant activity, driven by a diverse range of sectors including technology, finance, and healthcare. Companies eager to capitalize on favorable market conditions have launched IPOs, attracting substantial investments from domestic and international investors alike. This surge in IPO activity reflects Saudi Arabia's strategic efforts to diversify its economy away from oil dependence, fostering a more dynamic and inclusive market environment.

Markaz's report highlights Saudi Arabia's proactive approach in stimulating capital markets, with regulatory reforms and investor-friendly policies playing pivotal roles. These initiatives have bolstered investor sentiment, encouraging more companies to tap into the capital markets for growth and expansion opportunities. The kingdom's Vision 2030 agenda, aimed at transforming the economy and reducing reliance on oil revenues, continues to drive momentum in the IPO sector.

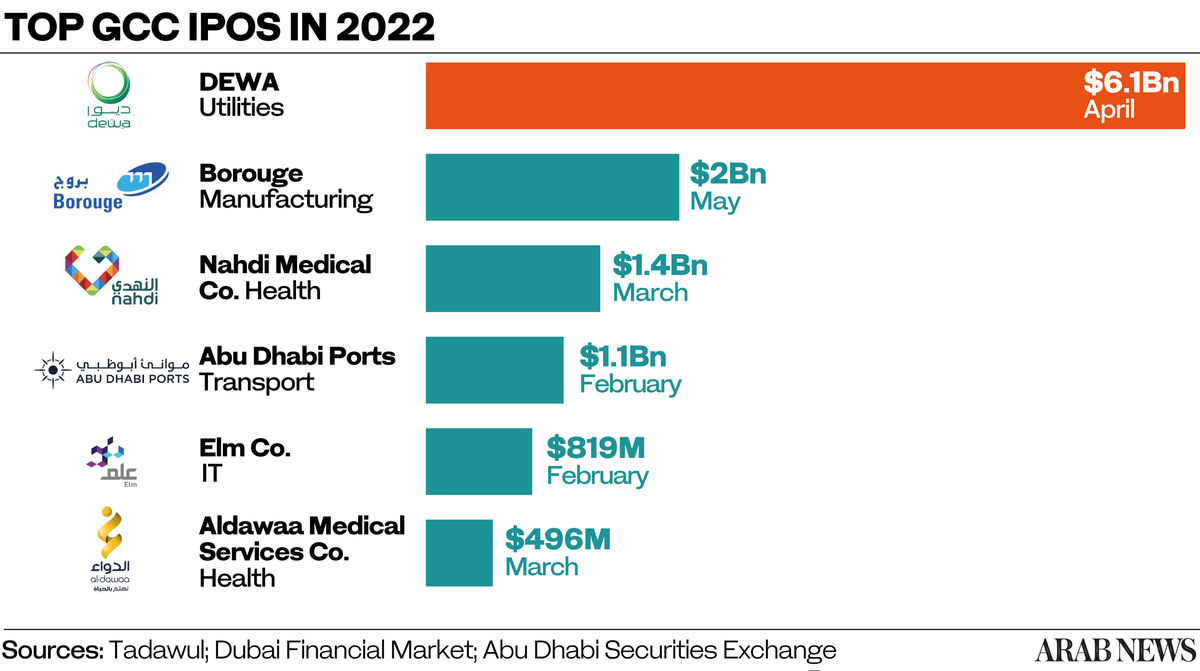

Across the GCC region, other countries have also witnessed notable IPO activities, albeit on a comparatively smaller scale. Qatar and the United Arab Emirates (UAE) have shown resilience in their respective markets, with several companies successfully launching IPOs amidst evolving economic landscapes. However, Saudi Arabia's dominance in fundraising underscores its position as a key player in the regional IPO market, attracting attention from global investors seeking growth prospects in the Middle East.

Analysts anticipate continued momentum in the GCC IPO market for the remainder of 2024, buoyed by economic reforms, technological advancements, and increasing investor confidence. As geopolitical and economic dynamics evolve, GCC countries are expected to navigate challenges while capitalizing on emerging opportunities in sectors such as renewable energy, digital transformation, and sustainable development.

The $2.1 billion raised by Saudi Arabia in the first half of 2024 not only reflects strong investor appetite but also signals the kingdom's resilience amid global economic uncertainties. With a strategic focus on diversification and economic transformation, Saudi Arabia aims to sustain its leadership in the GCC IPO market, contributing to broader regional economic stability and growth.

Saudi Arabia's robust performance in the GCC IPO market underscores its strategic initiatives and investor-friendly policies, positioning the kingdom as a key driver of economic growth and capital market development in the Middle East. As the year progresses, stakeholders will closely monitor how these dynamics shape the future trajectory of the regional economy and investment landscape.

Topics

Markets