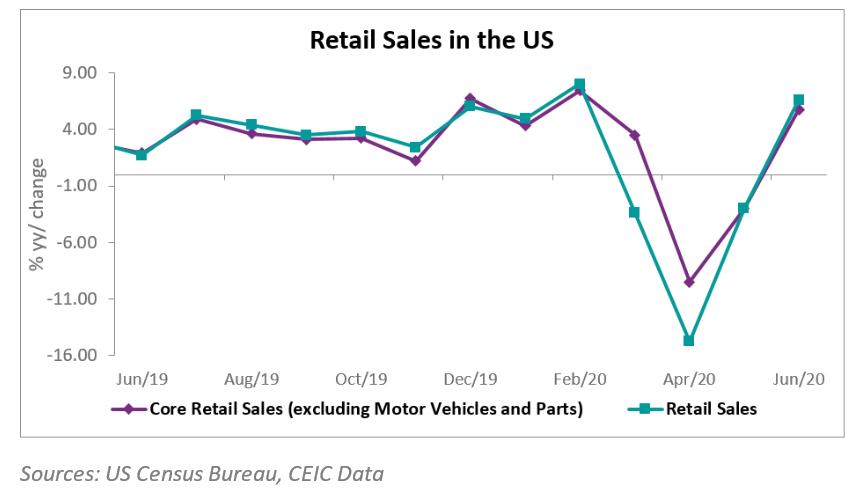

Retail sales, largely consisting of goods and unadjusted for inflation, reflect a mixed consumer landscape. While households increasingly prioritize essential purchases, there are signs of economic resilience. Core retail sales, excluding automobiles, gasoline, building materials, and food services, surged by 0.9% in June, following a 0.4% rise in May. This subset of retail sales aligns closely with the consumer spending component of the gross domestic product (GDP), suggesting that consumer spending continues to support economic expansion.

Households, however, are experiencing financial strain. Savings accumulated during the COVID-19 pandemic are depleting, and credit card debt is becoming more expensive due to high interest rates. Wage growth is also slowing as the labor market cools, adding further pressure on consumers. Despite these challenges, the pace of consumer spending has been adequate to sustain the economic expansion.

PepsiCo's CEO, Ramon Laguarta, highlighted the financial stress faced by lower-income consumers, noting their strategic budgeting efforts to stretch finances. This sentiment is echoed across various retail and manufacturing sectors, indicating a shift in consumer behavior towards frugality and essential spending.

Economic forecasts had predicted a growth rate of approximately 2% for the April-June quarter prior to the release of the retail sales data. The US economy grew at a rate of 1.4% in the first quarter, suggesting a steady yet cautious economic outlook for the remainder of the year.

Overall, while the stability in retail sales defied negative forecasts, the economic landscape remains complex, with consumer behavior adapting to ongoing financial pressures.

Topics

Live News