The IPO is expected to be one of the most significant in the region this year, drawing interest from both local and international investors. Arabian Mills, known for its wide range of food products, has established itself as a leader in the Saudi market. The company aims to leverage the IPO to bolster its financial position, fund new projects, and increase production capacity to meet growing demand.

Saudi Arabia's Vision 2030, an initiative aimed at diversifying the kingdom's economy, has paved the way for several companies to consider public listings as a means to attract foreign investment. Arabian Mills' decision to sell a 30% stake reflects the broader trend within the kingdom, where businesses are increasingly looking to the stock market for growth opportunities.

Analysts predict that the Arabian Mills IPO could be highly successful, given the company's robust market position and the strong performance of recent public offerings in Saudi Arabia. The food processing sector in the kingdom has seen substantial growth, driven by rising consumer demand and government support for local production. This favorable environment is expected to contribute to the positive reception of the Arabian Mills IPO.

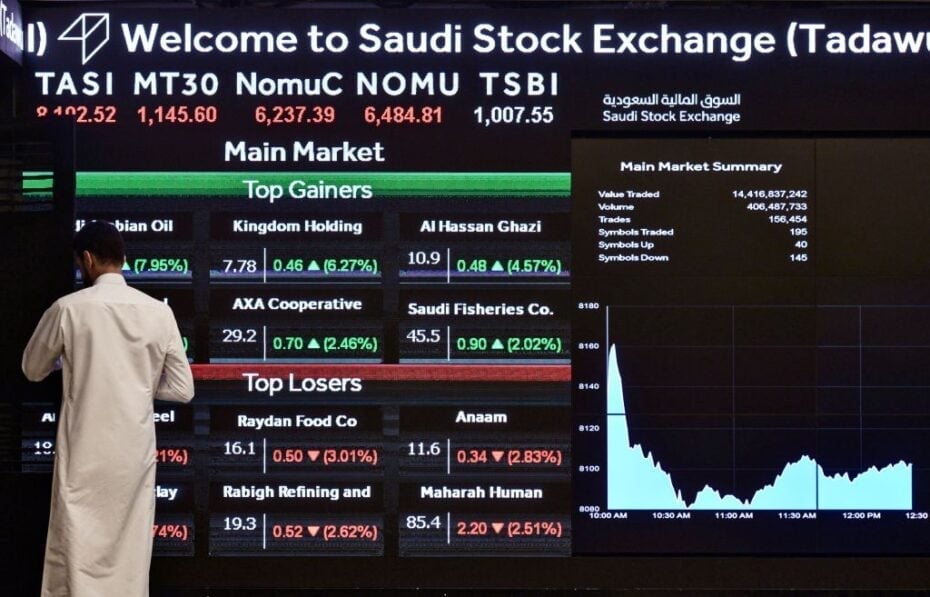

The exact timeline and pricing details for the IPO are yet to be disclosed, but industry experts anticipate that the listing will generate significant interest among institutional and retail investors. Arabian Mills' decision to list on the Saudi Stock Exchange underscores the growing confidence in the country's economic prospects and the increasing appeal of the Saudi market to global investors.

As part of its growth strategy, Arabian Mills plans to use the proceeds from the IPO to invest in new technologies, expand its product lines, and enhance its distribution networks. These initiatives are expected to solidify the company's position in the competitive food processing industry and support its long-term growth objectives.

The IPO also aligns with the broader economic goals of Saudi Arabia, which seeks to develop its capital markets and attract foreign investments as part of Vision 2030. By going public, Arabian Mills is set to play a key role in the kingdom's economic transformation, contributing to the diversification and modernization of its economy.

Arabian Mills' leadership expressed optimism about the IPO, emphasizing that the move will enable the company to accelerate its growth plans and create value for its shareholders. The listing is anticipated to provide Arabian Mills with the financial flexibility needed to pursue strategic acquisitions, enhance operational efficiencies, and explore new markets.

Overall, the Arabian Mills IPO marks a significant milestone for the company and the Saudi stock market, reflecting the ongoing evolution of the kingdom's economy and its commitment to fostering a vibrant, diversified economic landscape.

Topics

Spotlight