Hindenburg’s latest report suggests that Buch and her husband, Dhaval Buch, were connected to multi-layered offshore funds, some of which were allegedly involved in financial maneuvers tied to the Adani Group. These accusations stem from whistleblower documents, which Hindenburg claims to have included in its report. The timing of these revelations is particularly sensitive, as SEBI had been tasked by the Indian Supreme Court with investigating earlier claims of corporate fraud against the Adani Group, also brought forward by Hindenburg.

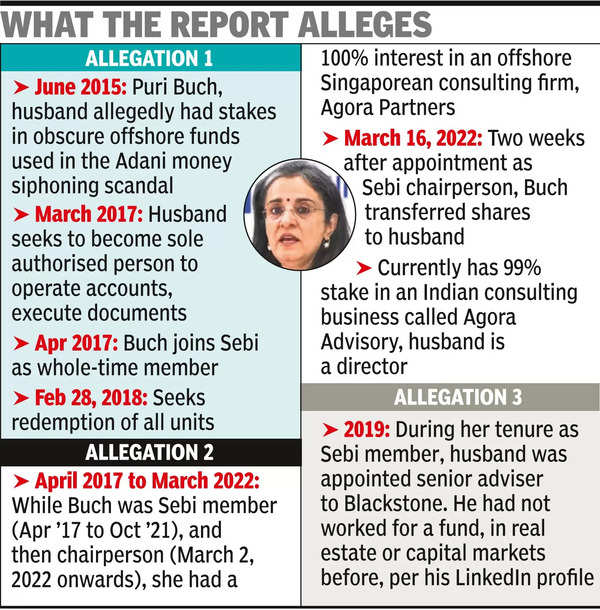

The report asserts that the Buchs held stakes in the same offshore funds used by Vinod Adani, brother of Gautam Adani, which were reportedly part of a broader cash siphoning scandal. Further, it alleges that during her tenure as a full-time member and later as the chairperson of SEBI, Madhabi Buch had financial interests in a Singaporean consulting firm that she later transferred to her husband shortly after her appointment as chairperson. These transactions, according to Hindenburg, raise questions about potential conflicts of interest that may have influenced SEBI's investigative rigor.

The implications of these findings have reverberated through India’s political landscape, with opposition parties quickly seizing the opportunity to demand a more extensive probe. The allegations also cast a shadow on SEBI’s independence and its ability to act without bias, particularly in high-profile cases involving powerful industrial groups.

The controversy has also drawn attention to the governance and oversight of SEBI, an institution expected to safeguard the integrity of India’s financial markets. As the situation unfolds, it remains to be seen whether the Indian government will initiate a deeper investigation or take action based on the findings presented by Hindenburg.

This report is part of Hindenburg's broader scrutiny of Indian entities, following its earlier high-profile accusations against the Adani Group in January 2023. The outcome of these allegations could have far-reaching consequences for both SEBI’s leadership and the broader perception of regulatory oversight in India.

Topics

World