At the heart of this deal is BlackRock Riyadh Investment Management (BRIM), a platform that will help channel capital into a variety of sectors in the kingdom. The agreement also underlines the growing stature of dealmakers within the PIF, who have taken the lead in spearheading major investment partnerships with global firms. The PIF’s ambitions include not only expanding the Saudi capital market but also developing the local asset management industry, which has become a crucial element in positioning the kingdom as a global financial hub.

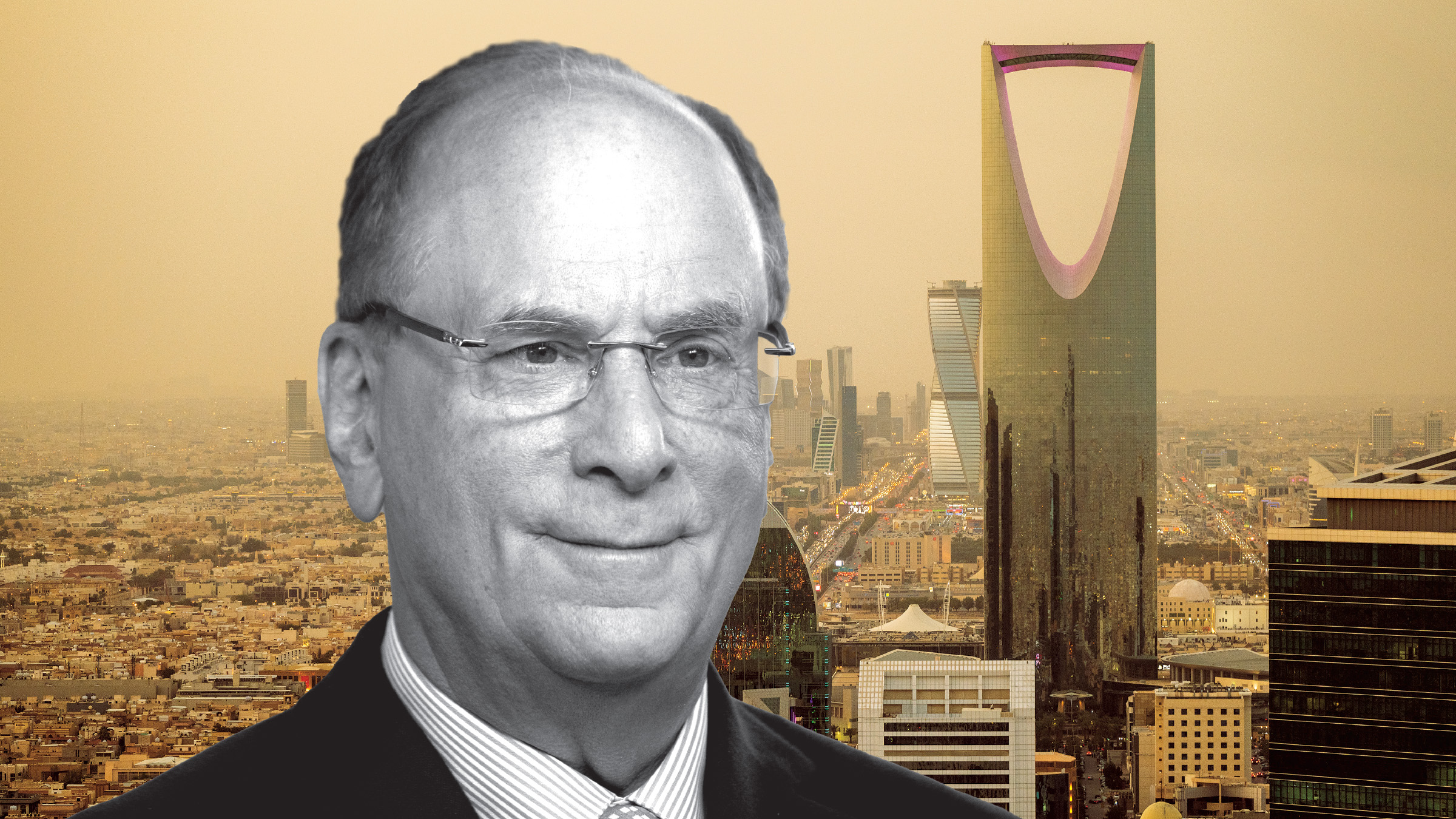

Larry Fink, BlackRock’s chairman and CEO, highlighted the importance of this partnership, noting that the firm’s expertise in capital markets will be a key driver of economic development in Saudi Arabia. Fink stressed that the project would integrate BlackRock’s global investment capabilities while also enhancing the region's financial ecosystem.

The Saudi PIF, which controls over $700 billion in assets, is central to the nation’s strategy of moving away from oil dependency and fostering new avenues of economic growth. Part of this effort includes establishing global alliances with leading financial institutions, a trend that has seen increased activity in the past years. The launch of BRIM is viewed as a pivotal step toward achieving the broader goals of Vision 2030.

This multi-asset platform will attract international institutional investors, offering them a channel to participate in the growth of the Saudi market, while also strengthening local expertise in asset management. Through a dedicated portfolio management team based in Riyadh, the platform is expected to leverage BlackRock’s technological tools and global leadership in investment management to benefit local players.

For Saudi Arabia, the deal also symbolizes a growing confidence in its financial sector's capacity to handle significant international investments. The PIF has steadily built a reputation for deal-making prowess, fostering strong relationships with global partners and securing high-profile investments across industries. While the PIF has been involved in notable ventures in entertainment, technology, and real estate, the BRIM partnership with BlackRock highlights a strategic shift towards developing a robust financial infrastructure in the kingdom.

This alliance with BlackRock is just one among many as the PIF continues to court global investors, capitalizing on its financial strength and long-term strategy. The wealth fund has been steadily raising its profile on the international stage, establishing a series of high-value collaborations aimed at reshaping Saudi Arabia’s economic future.

BlackRock's deepened presence in Saudi Arabia is also noteworthy as the firm looks to strengthen its footprint in the Middle East. Over the past few years, global asset managers have shown increased interest in the region, recognizing its potential for substantial returns amid widespread economic reforms. The PIF’s influence has been instrumental in driving these reforms, and the BRIM initiative is expected to set a benchmark for future collaborations between international financial firms and Saudi entities.

Analysts believe that the PIF’s growing stature as a financial powerhouse is tied closely to its ability to secure such landmark deals. As global markets face volatility, sovereign wealth funds like the PIF offer stability and significant investment opportunities, particularly in regions undergoing rapid transformation. This has been one of the key draws for BlackRock, which sees Saudi Arabia as a market with immense potential, particularly in sectors such as renewable energy, infrastructure, and technology.

Topics

Spotlight