In its World Oil Outlook, OPEC lowered its growth forecast for 2024 to 2.2 million barrels per day (bpd), down from a previous estimate of 2.4 million bpd. For 2025, the outlook dropped to 2.1 million bpd from an earlier projection of 2.3 million bpd. These adjustments underscore the organization's cautious stance in the face of a turbulent economic environment.

The ongoing effects of the COVID-19 pandemic continue to reverberate across global markets, impacting both demand and supply dynamics. Inflationary pressures have led to a slowdown in economic activity, particularly in major consumer markets. OPEC's adjustments come at a time when countries are grappling with high energy prices and shifting consumer behavior as they seek more sustainable and diversified energy sources.

Emerging economies, particularly in Asia, remain key drivers of oil demand, yet their growth trajectories are being tempered by financial constraints and evolving energy policies. Countries like China and India are expected to continue driving demand, but OPEC’s latest assessment indicates a more subdued growth outlook compared to earlier forecasts. For instance, while China is anticipated to account for a significant portion of the global oil demand increase, its economic growth has shown signs of deceleration. This reflects both domestic challenges and international trade uncertainties that have cast a shadow over its recovery.

OPEC's assessment highlights the ongoing transition towards cleaner energy alternatives. Many nations are implementing policies aimed at reducing carbon emissions, which affects long-term oil demand forecasts. Investments in renewable energy are rising, contributing to a gradual shift in consumption patterns that may further impact oil demand. The International Energy Agency (IEA) also supports this view, noting that oil demand growth may peak in the coming years as electric vehicles (EVs) and other sustainable technologies gain traction.

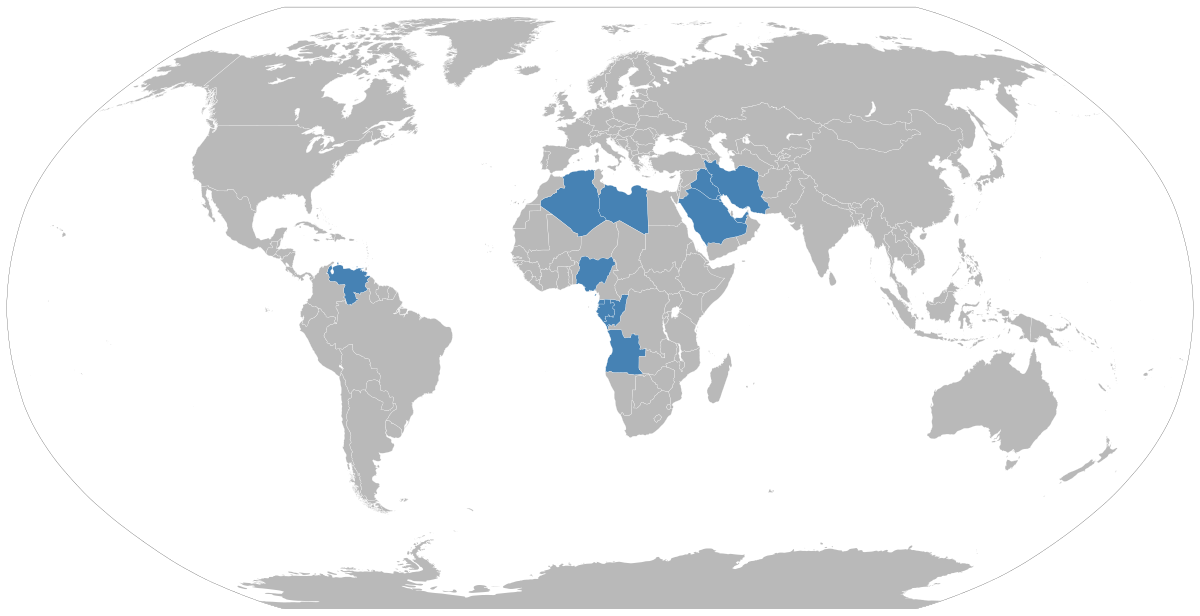

Geopolitical tensions in regions such as the Middle East, coupled with the war in Ukraine, are also complicating the landscape. Sanctions on Russian oil exports and ongoing conflicts have led to volatility in oil prices, making it challenging for OPEC to maintain stable output levels. The organization is continuously monitoring these developments, with members debating how best to balance supply and maintain price stability amid fluctuating demand forecasts.

Market analysts are closely watching OPEC's moves, given its influence over global oil prices. The organization's ability to manage production levels is critical, especially as it navigates the dual pressures of maintaining member compliance with output targets while responding to evolving market conditions. A failure to manage this balance could lead to heightened price volatility, further complicating the economic outlook.

The increase in production from non-OPEC countries, particularly the United States, poses additional challenges. U.S. shale producers have ramped up production in response to rising prices, which has led to increased competition for OPEC's market share. This trend is expected to continue as U.S. producers leverage advancements in extraction technology to maintain output levels.

Investors and traders are keenly aware of OPEC's new outlook, which could influence trading strategies and investment decisions in the energy sector. A lower demand growth forecast typically signals a potential decrease in oil prices, as excess supply may saturate the market. Therefore, market participants are advised to remain vigilant and responsive to OPEC's signals regarding production adjustments and future forecasts.

Topics

Spotlight